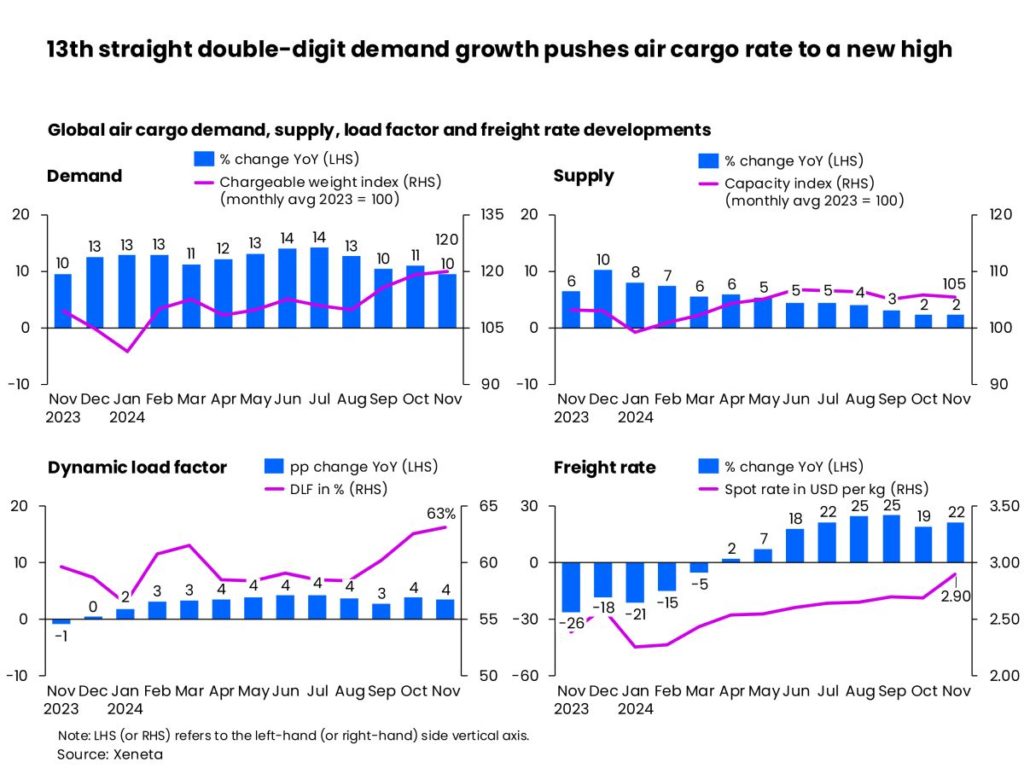

Global air cargo demand showed no signs of slowing in November as volumes recorded a 13th consecutive month of double-digit growth and load factors hit their highest level since April 2022, according to the latest market analysis by Xeneta.

Demand rose +10% year-on-year in November, fuelled by the continued boom in e-commerce. This, coupled with only a +2% growth in air cargo capacity, contributed to global air cargo spot rates also reaching their highest level in nearly two years at US$2.90 per kilo, a sixth consecutive month of double-digit year-on-year growth.

The strong monthly performance in 2024 had led to hopes of a ‘peak of all peaks’ in Q4 from some sectors of the market. Niall van de Wouw, Xeneta’s chief airfreight officer, however, says the industry has done well to avoid it.

“The peak of all peaks should not be a goal. It should be avoided because of the imbalance it creates between winners and losers; 2024 had all the ingredients to see crazy peak season rates but the fact we haven’t is another sign of the maturity we previously referenced in the global air cargo market. What we witnessed in 2023 was a mess and a valuable lesson. In 2024, we are seeing those lessons put into practice,” he said.

He continued: “People should not be disappointed. We are witnessing a much more grown-up air cargo market based on better allocation of resources and better terms and conditions between all parties involved. The peak in 2023, in comparison, saw a shortage of capacity and rates going crazy, all at the expense of shippers.”

He added. “Why would we want to go back there again? The supply chain pressure of a peak of all peaks would have hurt consumers and put unnecessary restraints on relationships. It would have been opportunistic for short-term gains.”

Van de Wouw says the final months of the year have seen the air freight industry “take control of its own destiny.”

While some observers have indicated a muted end-of-year air cargo market, van de Wouw called for perspective. He said: “This is an air cargo industry that is currently firing on all cylinders, but which is not out of control. November’s data shows a market where volumes were +10% higher than an extremely busy corresponding peak month last year, and rates have risen, too.

“The closing months of 2024 could have been very messy again for shippers, but we are not hearing that. That’s not because the volumes are not there, or the flights are not full. It is because everything, overall, is being managed better. The industry should take a lot of credit for that.”

Spots remain above seasonal rates

This persistent supply-demand imbalance of 2024 pushed the dynamic load factor in November to 63% – its highest level in over 30 months. Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

This level of demand has strengthened the negotiating position of carriers and seen global air cargo spot rates remain above seasonal rates since late November 2023.

In terms of month-on-month trends, this year’s peak season, however, has been less intense than last year’s. Thanks to carriers’ proactive capacity management, the global air cargo spot rate increased only +12% between early September (the start of peak season) and the week ending 1 December, compared to a +25% surge during the same period last year.

This trend is particularly evident in the outbound Asia market. As carriers have shifted capacity to accommodate surging cargo demand, November spot rates from Northeast Asia experienced moderate growth. Its spot rates to Europe rose by +13% month-on-month to $5.09 per kg, while spot rates to North America increased +5% to $5.20 per kg.

Additionally, spot rates from Southeast Asia showed mixed results, with those to Europe remaining flat at $4.15 per kg and North America declining -3% to $6.05 per kg. The latter was driven by easing volumes, after spot rates exceeded last year’s peak season levels since late May 2024.

The Transatlantic market experienced more dramatic freight rate increases as cargo capacity moved elsewhere at the end of the summer passenger travel season. Europe to North America spot rates climbed by +46% from the previous month to $2.72 per kg, which is in contrast to the just +9% month-on-month growth during the same period a year ago.

Similarly, Europe to Latin America rates rose by +23% to $4.58 per kg. In Brazil, a five-day embargo in early November in Sao Paulo, South America’s largest cargo airport, coupled with ongoing nationwide digital customs delays caused by Brazilian Customs’ strike since 26 November, may push air cargo spot rates even higher in December. Shippers are likely to resort to air freight to avoid customs clearance delays.

Van de Wouw commented: “I think the air cargo industry should be proud it has avoided a ‘peak of all peaks’ because this is the basis for greater market stability. I hope this will enable everyone to head into their well-earned Christmas and New Year holidays with a sense of satisfaction.

“In 2024, the industry has shown its maturity. We must wait and see if this holds when the market goes down, but I don’t see that happening just yet.”