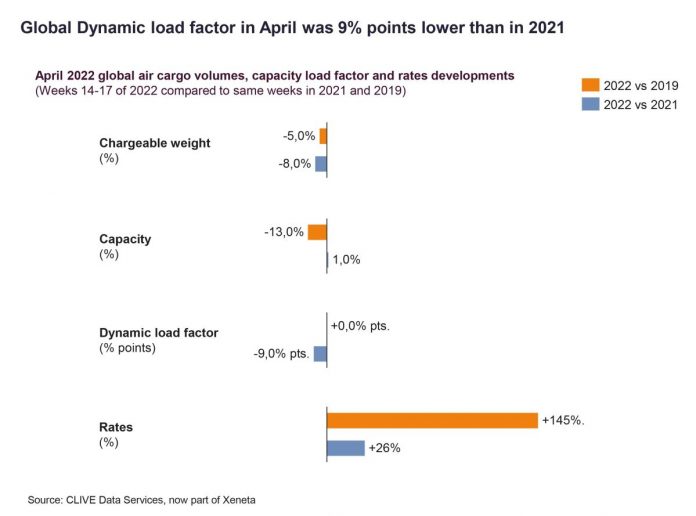

Factors which curtailed the growth recovery of air cargo in March continued to impact the industry in April with volumes down 8% year-over-year, says Xeneta’s CLIVE Data Services

Rates remained high despite the addition of new capacity, as airlines launched their summer schedules, the analyst explained.

The conflict in Ukraine, Covid lockdowns measure in China and the high cost of living all contributed to the fall in demand, which is also likely exacerbated by the staff shortages jolting airport handling services and manufacturing. Volumes in April were down 5% compared to the same month of 2019, before the pandemic took hold.

Xeneta chief airfreight officer Niall van de Wouw, said: “The rationale behind lower load factors and higher rates is the bottleneck on the ground – which appears to be being caused now by not only the shortages of people handling cargo at airports around the world and the severe lack of truck drivers to move the goods, but also by a wider shortage of people for lower paid logistics jobs. We are now seeing this larger theme impacting the entire supply chain.”

Shortages of goods in stores or available online, longer lead times for some products, higher shipping costs, and flight delays and cancellations are all consequences of these market conditions, he added. The hike in living costs and lower disposable incomes for consumers are other undoubted contributors to the slowdown.

CLIVE’s dynamic load factor from Europe to North America averaged 70% in April 2022, a drop of 12% points in just one month, and the first time in two years it has fallen below 80it said. This was caused by a big jump in North Atlantic passenger capacity as airlines stepped up their summer schedules. It is also expected to “takes some of the heat out of the demand/supply market,” Niall van de Wouw said, and potentially lead to a downward pressure on rates.

“During the last week of March, capacity increased by 15% compared to the previous week. This significant increase in space reinforces our previously stated forecast that the North Atlantic market will most likely be the first to return to some kind of normal, because of the high share of belly capacity on this lane. In terms of the dynamic load factor, we are seeing this shift starting to happen as we move from a seller’s market to a buyer’s market for air cargo. However, the issues on the ground might delay the buyer’s market a bit longer,” he added.

Spot rates from Europe to North America remained relatively unchanged. The spot share – the amount of weight being sold against a short-term rate – decreased however by close to 5% points to 44% from 49% in March, again potentially indicating a softening of the market.