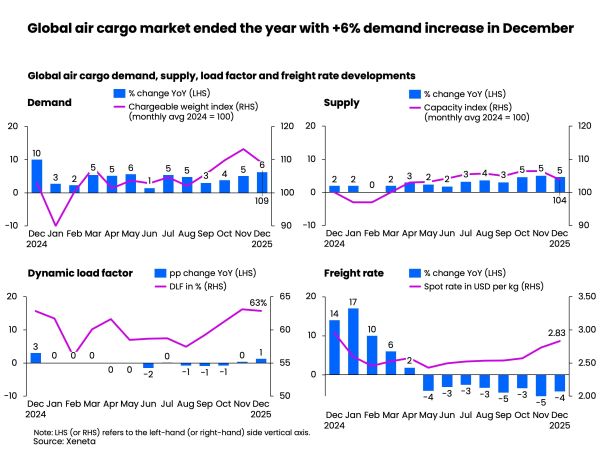

Global air cargo demand finished a tumultuous 2025 on a high with volumes up +6% year-on-year in December, but flatlining e-commerce shipments ex-China will create concern for airlines and forwarders reliant on consumers’ online buying sprees, say industry analysts Xeneta.

Better-than-expected volumes over the last quarter of the year helped air cargo demand record +4% growth in chargeable weight year-on-year for 2025, reflecting many shippers’ willingness to shift away from other modes to the speed and reliability of air cargo during times of disruption and economic uncertainty.

2025 had “something for everyone,” said Xeneta chief airfreight officer, Niall van de Wouw, with service providers benefitting from higher volumes than expected earlier in the year, and shippers gaining from lower rates in the second half of the year.

Having predicted up to +4% market demand growth for 2025, Xeneta sees a more cautious outlook for 2026, forecasting a slightly more modest +2-3% rise in volumes this year.

Price to pay in 2026?

After +11% growth in 2024 and market resilience seen in 2025, van de Wouw says there might be “a price to pay” for air cargo volumes in the coming year.

“Everybody had some doom and gloom about 2025 when the US started announcing tariffs, but the uncertainty helped airfreight. The market held up better than many expected as trade patterns shifted – buffeted by the return of Trump tariffs and de minimis bans for e-commerce shipments in the US, and the fading boost from Red Sea-related ocean freight diversions,” van de Wouw said.

“But with many questions remaining over trade, and geopolitical tension adding a further layer of uncertainty, I personally think something has to give in 2026 from a volume perspective – and that means there’s going to be more in it for shippers in terms of lower rates,” he added.

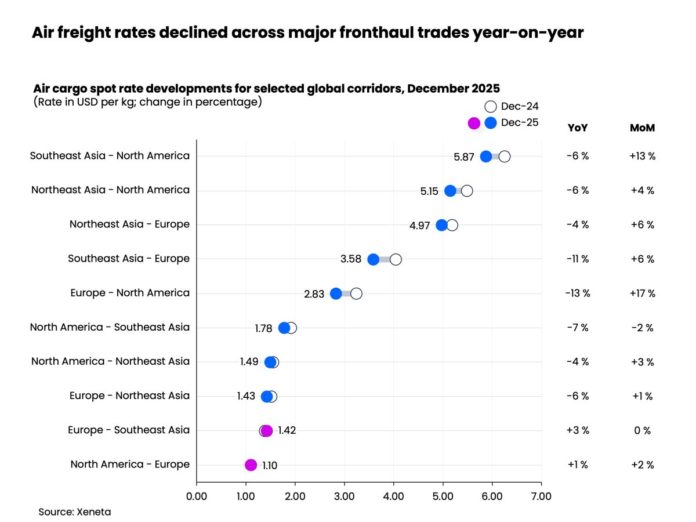

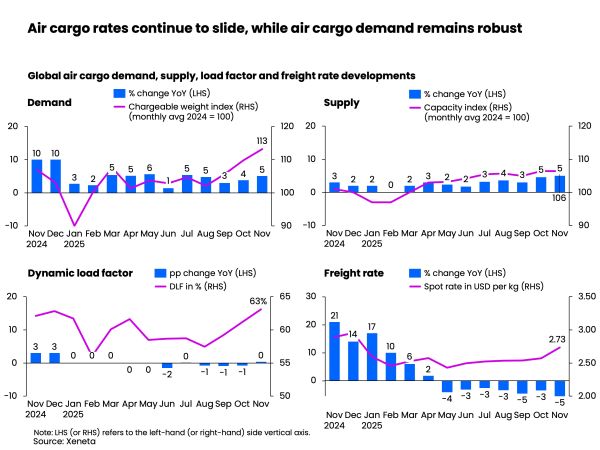

Despite demand growth towards the end of last year, average global airfreight rates have been below their 2024 levels in recent months. This trend continued in December as, once again, demand outpaced the +5% growth in supply. Global airfreight rates fell -4% year-on-year to average USD 2.83 per kg, slightly less pronounced than November’s -5% decline, suggesting the slide may be easing, but not reversing.

Less buoyant signals for e-commerce

What happens next will be heavily influenced by e-commerce, with shippers in China, Europe, and elsewhere facing higher delivery costs.

Van de Wouw said: “One of the tailwinds for air cargo demand growth in 2025 came from investment linked to the development of artificial intelligence solutions. This supported flows of high-value goods and is expected to continue. In contrast, the less buoyant forward-looking signals for e-commerce, particularly Chinese cross-border e-commerce exports, are worrying.”

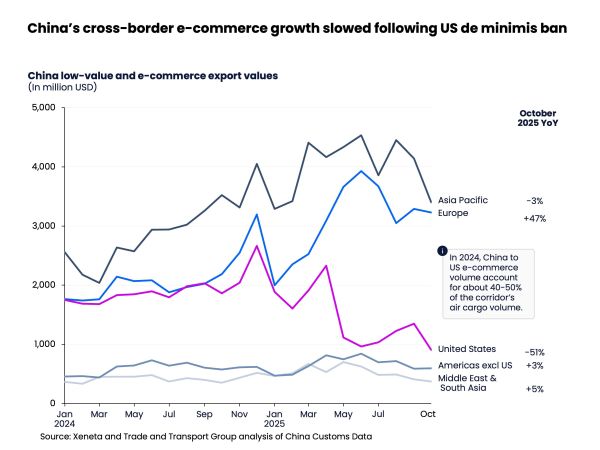

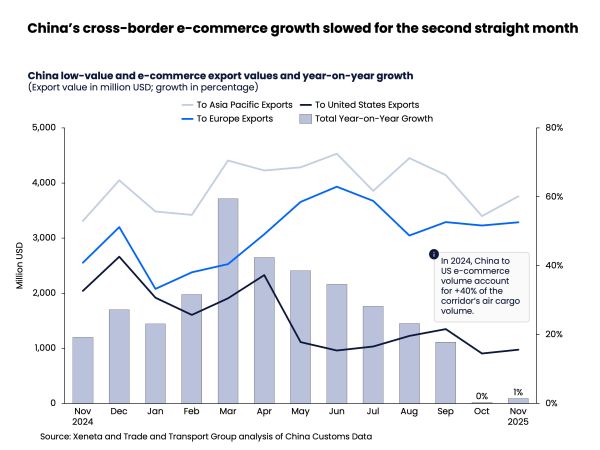

Chinese customs data shows low-value and e-commerce exports in November rose by just +1% year-on-year, after flatlining in October. Exports to the US represented the brunt of this decline, plunging -52% year-on-year in November after a corresponding -51% fall in October, the steepest declines on record. Prior to the de minimis ban imposed by the US government, China–US e-commerce accounted for roughly 3% of global air cargo volumes.

China–EU e-commerce volumes continued to grow, but less briskly, expanding +29% in November. This is down from the +47% recorded in October.

Policy is now biting from China as well. China’s State Council has introduced new rules on tax information reporting by online platforms. From October 2025, marketplaces such as Amazon, Temu, and eBay must report tax-relevant data on merchants and individual service providers to improve transparency and compliance. Non-compliance can be costly, with exporters facing fines up to CNY 100,000 (about USD 14,000) if they miss the data deadline or report incorrectly. In severe cases, penalties can reach CNY 500,000 (around USD 71,000) and include business suspension pending rectification.

More regulated e-commerce

International cross-border e-commerce will face a more regulated landscape across many fronts. The US and the EU are leading the charge, but countries including Japan and Thailand have also discussed or announced new rules commencing in fiscal 2026. In December, the EU, for example, agreed to impose a fixed customs duty of EUR 3 on small parcels valued below EUR 150 from 1 July 2026, aiming to close loopholes used by low-value shipments – 91% of which originate in China. Consequently, e-commerce volumes are likely to grow at a slower pace in 2026, but still faster than the general airfreight market, as platforms continue to respond to policy changes and shifting trade flows.

“China’s cross-border e-commerce volumes were flat in October and November. If we see a third consecutive month of lower e-commerce growth out of China, that is a big signal – while duties imposed by other countries may present more unwelcome news for the air cargo market going forward.

“Air cargo’s e-commerce volumes are also likely to be impacted by declining consumer purchasing power as they face higher prices for more essential everyday items, making consumers more mindful of how they spend their money,” van de Wouw believes.

Spot rates continue to decline

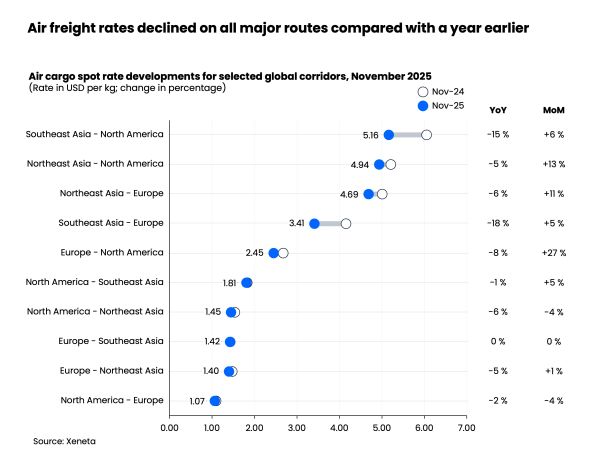

On the main corridors, December spot rates mostly extended their year-on-year decline. The sharpest fall (-13%) came on the transatlantic westbound lane, from Europe to North America. Demand slipped -2% from a year earlier, a touch faster than the -1% reduction in capacity. Yet month-on-month the story was different. With reduced passenger belly capacity, spot rates jumped +17%, the quickest increase among the major corridors, but still below the same period of 2024.

Southeast Asia-related lanes posted the next largest year-on-year drops. Spot rates from the region to Europe and North America fell by -11% and -6% respectively year-on-year as capacity expanded. Even so, rates rose strongly month-on-month, up +6% to Europe and +13% to North America, outperforming last year’s seasonal pattern (-3% and +3%).

Northeast Asia was steadier. Air spot rates to Europe and North America fell by around -5% year-on-year and rose by approximately +5% month-on-month. Mainland China stood out for its relative balance as spot rates from China to Europe and North America were just -1% below December 2024 levels.

Airlines managed to quickly reallocate freighter capacity away from the US and towards Europe, where demand has been more accommodating. Even so, China’s month-on-month increases were sharper at around +9% into both Europe and North America, hinting at greater supply/demand imbalance.

Forwarders take short-term approach

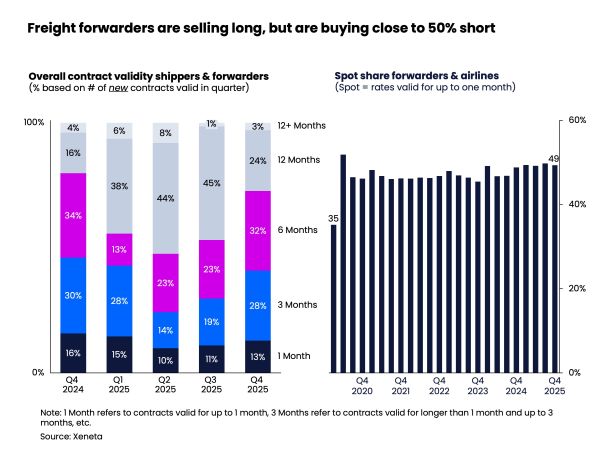

Contracting behaviour shifted, too, as 2025 came to a close. Airlines and freight forwarders remain focused on the short term: close to half of forwarders’ volumes were bought in the spot market valid for up to a month, a habit that has lingered since the pandemic. Shippers showed a notable change in approach to cargo capacity in the fourth quarter. One-year contracts accounted for only 24% of new deals in Q4 2025, down 20 percentage points from the previous quarter, as buyers seemed unwilling to lock in rates during peak season and bet instead on further price erosion.

Still, compared with Q4 2024, the share of one-year contracts was 8 percentage points higher. If demand is set to lag supply in 2026, the question is whether longer-term contracts regain ground – back towards Q1 2025’s 38 – or whether shippers increasingly mimic the industry’s prevailing short-termism.

Fundamentals point downwards

The volatile nature of trade and world affairs, van de Wouw said, continues to mean that any sign of crisis this year may yet again help airfreight, but, until then, he sees the market fundamentals pointing downwards in 2026.

“When I look at the biggest risks this year, right now I would say it’s more likely we will see something that will put a stopper on the level of airfreight growth we have seen in the last two years. Overall, the market has been relatively stable, but we are entering a phase when shippers will be looking for better rates and demand may deteriorate in the first quarter of the year.”