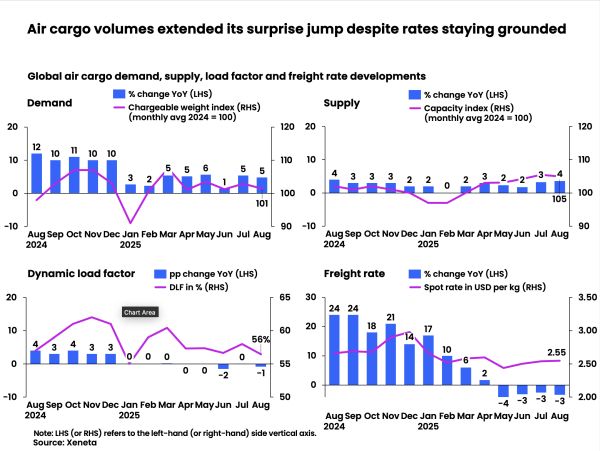

A surprise summer of growth in global air cargo volumes showed no sign of abating in August as demand rose 5% year-on-year for a second consecutive month, says analyst, Xeneta. However, falling spot rates are likely to be a more telling indicator of the market outlook as shippers, airlines, and forwarders continue to battle against economic uncertainty,.

Despite the rise in cargo volumes, alongside a similar +4% year-on-year growth in capacity supply, the average global spot rate fell for a fourth month in a row, down -3% to US$2.55 per kg. And it’s these freight rates which may signal a challenging next few months for the air cargo market, according to Xeneta’s chief airfreight officer, Niall van de Wouw.

The August decline in spot rates is likely even steeper once currency effects are considered: all rates are converted into dollars, which have lost -4% against other currencies over the past year. Shift in trade flows may be weighing on air cargo rates.

Consider China-US air cargo, for instance, which, in August, was priced at $4.30 per kg. Many e-commerce shipments have been re-directed to the China-Europe corridor due to US de minimis bans, where the rate was $3.65 per kg. Such reallocation drags down the global average. A -7% drop in jet-fuel prices may have also helped keep airlines’ costs down, muting pressure on rates for now.

“It is often said that airfreight is a bellwether for macroeconomics, but I don’t think it is at the moment,” he said. “We’ve now reported +5% growth in demand for July and August and it would be easy to take some comfort from these volumes were it not for the current market conditions.

“Right now, volumes are certainly not as bad as people feared, but also not as good as people hoped. In our April data, on the back on the US administration’s ‘Liberation Day’ tariffs announcement, we asked ‘how bad will it get?’ for air cargo demand. We still cannot answer that question,” van de Wouw added.

“More than ever, shippers are falling into three categories right now,” Niall van de Wouw said. “There are those who will always say ‘no way’ to airfreight because their products simply cannot justify the higher cost of air versus ocean freight. Then there are traditional air cargo customers who always ship goods by air because of its speed and value for their high-priced or more perishable or time-sensitive products.

Between these two views sits a bigger group of shippers who will use ocean to move their goods if they can, and airfreight if they must. It is this segment of the market which is driving the upturn in airfreight demand we are seeing.

“Air cargo’s higher demand remains the result of mode shift we saw in July, with a bit of support from e-commerce. It is not an indicator of increased economic activity. It’s just that airfreight is getting a bigger share,” he continued. “Many shippers looking to lessen the impact of tariffs just do not know how the market will look in 3-4 weeks’ time because of the lack of clarity.

“Consequently, I think more businesses are deciding to take a hit and move their products by air – but this good news for the air cargo market remains under constant review. Overall, it’s hard to see where strong, sustainable airfreight growth will come from,” he said. “One forwarder I spoke to this week said that while air shipments related to AI are one of the few verticals showing a little bit of growth, they had far lower expectations for big and typically regular airfreight users like automotive, pharmaceuticals, and high-tech. I think this sentiment will resonate with a lot of other companies.”

Downward pressure

Whether it’s frontloading supply chains, ‘piggybacking’ on concerns of the financial implications of tariffs, or efforts to avoid or minimise their impact, there is little doubt that air cargo’s unexpected summer demand growth is based on the continuing unpredictable nature of world trade – but rate pressures are increasing.

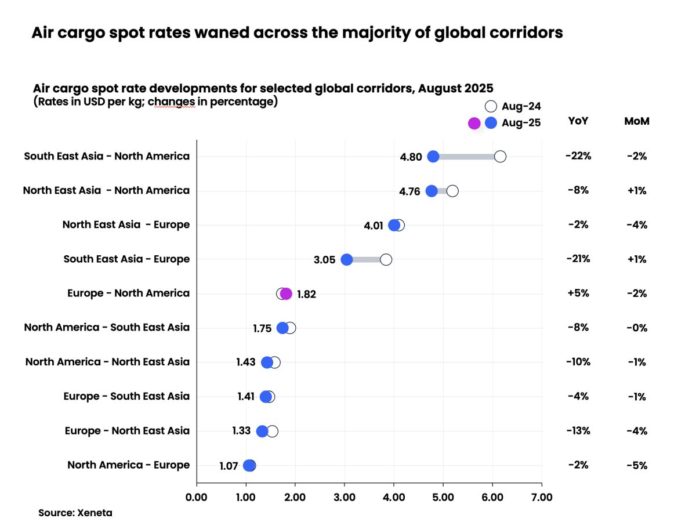

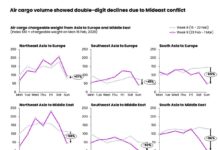

The downward trend for global spot rates was echoed across most major air cargo corridors. In August, outbound flows from South East Asia continued to tumble, with air cargo spot rates to North America and Europe dropping by more than -20% year-on-year, to $4.80 and $3.05 per kg respectively, as capacity constraints eased.

North East Asia to North America routes fared somewhat better, with rates down -8% year-on-year and remaining stable compared with July. Delicate capacity management narrowed the pricing gap with South East Asia to less than five cents, settling at $4.76 per kg.

Similarly, North East Asia to Europe spot rates, at $4.01 per kg, held steady compared to a year ago and showed a more modest decline (-4%) from a month earlier. But this is at the cost of backhaul prices, which showed a -13% year-on-year decline due to continued trade imbalance.

The Transatlantic market remained the only bright spot, posting a +5% rise in spot rates year-on-year to $1.82 per kg. Yet this was a sharp deceleration from July’s near +20% surge. Spot rates appear to have peaked in mid-August, before retreating in tandem with an -11% fall in volumes in the weeks that followed. Seasonal holiday slowdowns in Europe and the fading effect of frontloading – previously spurred by extended Trump tariff deadlines – played their part in the lower demand.

From 29 August, the end of the US de minimis exemptions globally added further turbulence. Several countries suspended postal services to the US in anticipation of new compliance requirements. Following China’s early exposure in May, Canada, the UK and Mexico – together accounting for the bulk of the remaining third of affected flows – will be next to feel the pinch.

Adding to market uncertainty, Purchasing Managers’ indices in the big exporting economies fell in August, and American consumer sentiment also softened.

Elsewhere, exports from Vietnam and Taiwan to the US have surged by double digits this year, while e-commerce demand has fuelled a boom on routes from North East Asia to Europe. Latin America-to-Europe flows are also on the rise. A broader revival may be sensed from any pre–Golden Week rush in China, ahead of the national holidays in 1-7 October. For now, however, the skies remain unsettled.

E-commerce to the rescue?

The rise of the Chinese e-commerce behemoths driven by unrelenting consumer demand for quick deliveries of lower-priced goods, especially in the US and Europe, came to the rescue of the air cargo market in Q4 2023, and steered double-digit, month-on-month demand growth throughout 2024 – but the removal of the de minimise threshold for duty free goods entering the US may have a profound effect of 2025’s ‘peak season,’ van de Wouw believes.

“A lot of people think of de minimis as being about B2C, but the de minimis changes now in effect are also a big thing for B2B into the US and we are already seeing some SME businesses reacting to, and challenging, this impact.

“The starting point for closing the de minimis threshold was mainly politically motivated against the big Chinese ecommerce platforms. But the widening of this legislation is levelling the playing field again for all e-commerce shipments entering the U.S, and I would now expect to see lower e-commerce volumes moving by air from Europe to the US If anything, observers suggest this will now benefit China because of its lower production cost base.

“So, I see this having a bigger impact on B2B business and less on B2C. It adds another barrier of administrative procedures, and cost to the supply chain,” he stated.

Van de Wouw concluded: “In terms of disruption to world trade, the uncertainly seems set to remain with so many questions unanswered. What has been formalised and what hasn’t? What will the removal of de minimis mean for cross-border e-commerce?

“And the biggest question still – how bad is it going to get? The predictions are concerning but, because of all the uncertainly, the hurt for airfreight has been softened and delayed. But, for how much longer is anyone’s guess.”