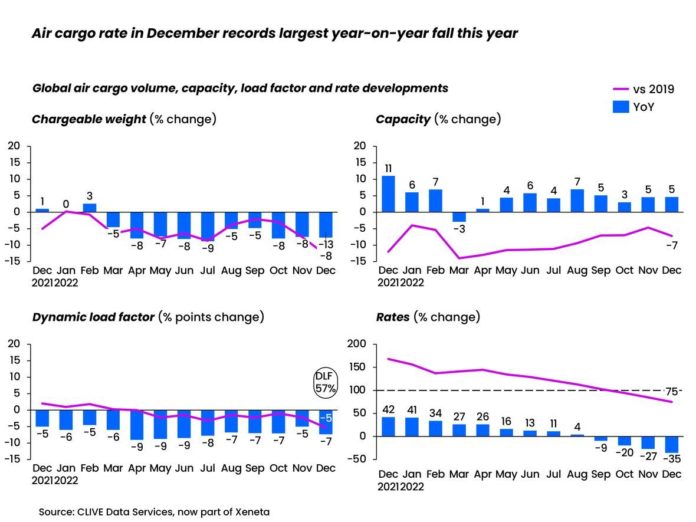

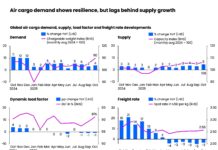

CLIVE Data Services, part of Xeneta, said that the global air cargo market ended December 2022 with a fall in chargeable weight of 8% compared with a year ago while the general airfreight spot rate registered its largest year-on-year decline of 35%. However, overall average rates remained 75% above the pre-covid level it said.

The 8% fall in global air cargo volumes represented the tenth consecutive month of lower demand, down -13% compared to 2019, at a time when available airfreight capacity continued to recover to above last year’s level. Capacity in December 2022 recovered to 93% of the 2019 level. CLIVE’s dynamic load factor declined by 7% pts year-over-year to 57% and was 5% pts below the figure for December 2019.

Chief airfreight officer at Xeneta, Niall van de Wouw, commented: “It would be easy to take a pessimistic view of the global air cargo market’s downturn, but this would ignore where it has come from. There is little use comparing it to the same time last year because then we had no Ukraine conflict, no high energy prices, no soaring interest rates, nor the impact of the subsequent cost-of-living pressures. So, based on the global environment we see right now, airlines are still achieving rates 75% higher than pre-Covid.

“That indicates the glass is very much still half full. If, in January 2020, you had asked airline executives if they’d like to see airfreight rates across the Atlantic or from Asia Pacific 75% higher, we would have heard a unanimous ‘yes’. The difference now is that there’s less pressure if you’re a shipper, even though you’re still paying more. In terms of the long-term sustainability of the air cargo supply chain, this will help.”

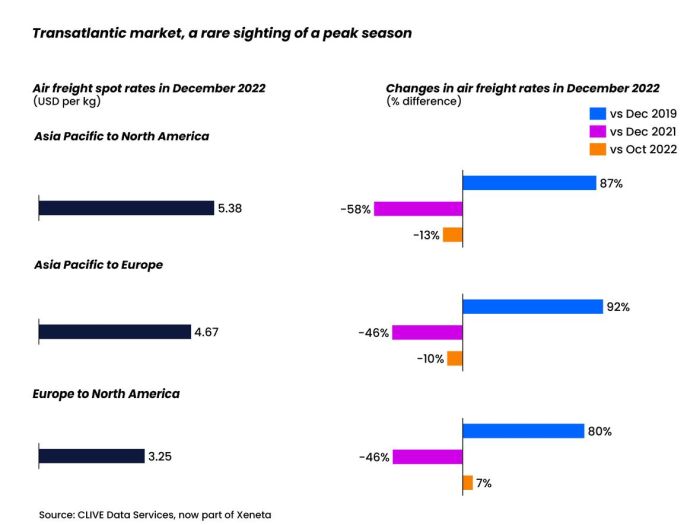

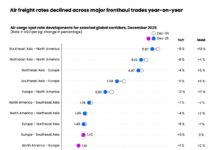

Airfreight spot rates on top volume corridors declined more sharply in December. Outbound Asia Pacific spot rates have been falling for eight consecutive months, with spot rates from Asia Pacific to North America of US$5.38 per kg for the final month of the year, down 13% since October. This represented a 58% decline on a year ago but remained 87% above the 2019 level.

On the Asia Pacific to Europe corridor, the average December spot rate dropped 10% compared to October to US$4.67 per kg, -46% year-on-year but, again, remaining 92% above the pre-pandemic level.

Reducing winter flight schedules contributed to some resilience to this year’s market headwinds on the Europe to North America corridor. December’s airfreight spot rate stood at US$3.25 per kg, up 7% over the October level. Replicating the market trends on the other main lanes, this rate was -46% versus a year ago but still 80% up on 2019.

The future remains uncertain. After a surprisingly strong start for the air cargo market in January 2022, 2023 will likely be impacted by the earlier Chinese New Year and growing concerns over Covid which, in China, is already impacting some factory production.

Van de Wouw added: “Of course, we wish the air cargo industry a very happy New Year, but it’s clear it remains in a very unpredictable state given world events. We don’t see demand recovering quickly because of what is happening around the world, but we do expect to see supply continuing to come back into the market. This, of course, will put further pressure on load factors and rates.

“So, we struggle to see where the tailwinds will come from, but looking at the broader perspective, we still see a very efficient air cargo market, especially when compared to the 70-80% fall in ocean rates in the past 8-9 months. The fact that the airfreight domain is more competitive and more fragmented on the supply side meant rates didn’t go as crazy as we saw with ocean container prices, so the decline, now airfreight volumes are lower, is more gradual. Air cargo is much stronger than it was pre-Covid, but the current direction of the market means there is some degree of good news for everyone.”