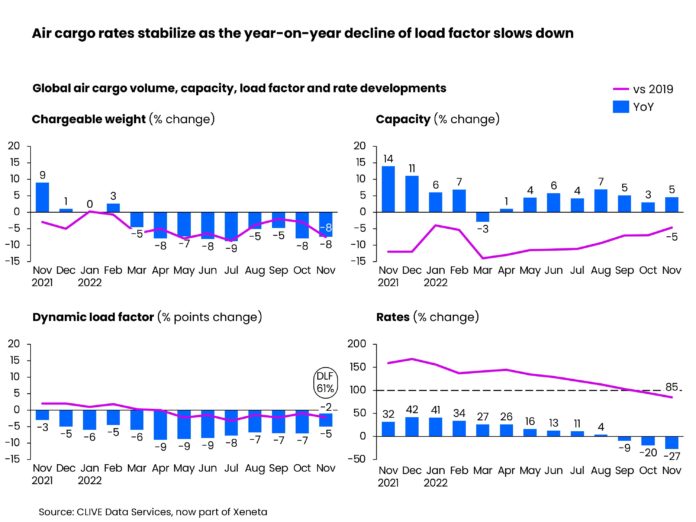

Freight forwarders are taking a ‘wait and see’ approach before making long-term air cargo capacity commitments demand dropped 2% month-over-month in November , says the latest weekly market by Xeneta’s CLIVE Data Services.

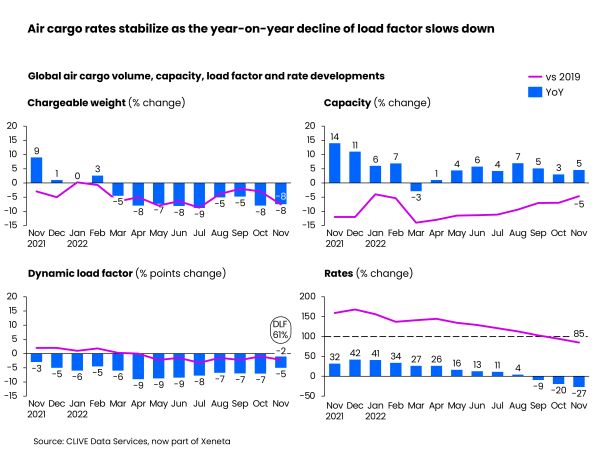

Chargeable weight in November was down 8% versus the same month of 2021, although the 1% reduction in global air cargo capacity, as airlines adapted to winter schedules, contributed to a ‘dynamic load factor’ of 61%, on a par with the previous month.

Load factors, however, continued to sit well below last year’s extraordinary peak season. For instance, Europe to North America load factor in the week leading up to the Thanksgiving holiday sat at 74% this year, down 12% from the same week last year.

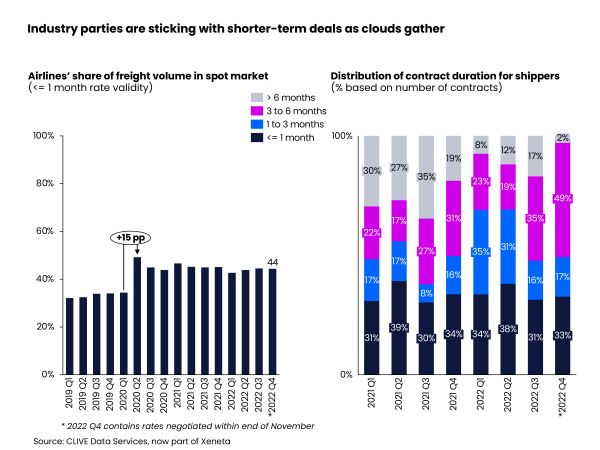

Amidst so much market uncertainty, shippers are increasingly choosing shorter-term deals as they wait to see how business trends unfold in the coming months. Commitments to over three-month contracts hardly exist in the fourth quarter this year.

Chief Airfreight Officer at Xeneta, Niall van de Wouw, said: “After such a big drop of -8% in air cargo demand in October, we saw a little stability return in November, so the market is not worsening, it’s just very hard to read longer-term. This is reflected in the rise in short-term contracts, with forwarders unwilling to commit to long-term deals.

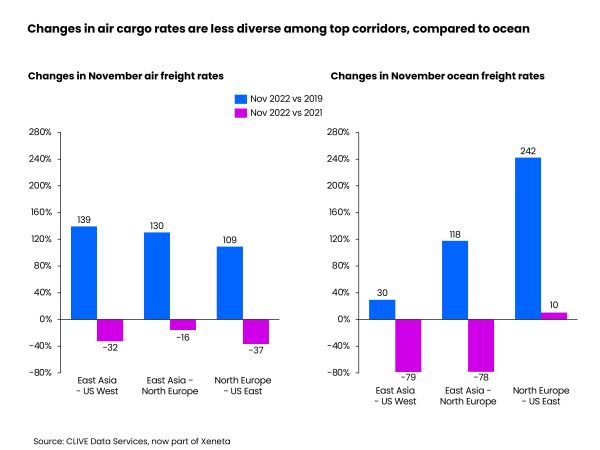

“Shippers should see some benefit from this in terms of their air and ocean budgets, and falling rates may provide one glimmer of hope for cash-strapped consumers that potentially lower shipping costs in 2023 will make some goods more affordable. There are still so many influencing factors to consider, including the depreciation of the US dollar and its impact on trade.”