The prolonged rise in the airfreight market finally came to an end in December, according to industry analysts, CLIVE Data Services.

Continuing supply chain issues, congestion on the ground, and concerns over the new Omicron virus suppressed any end-of-year uptick, it said in its latest report, published on 5 January.

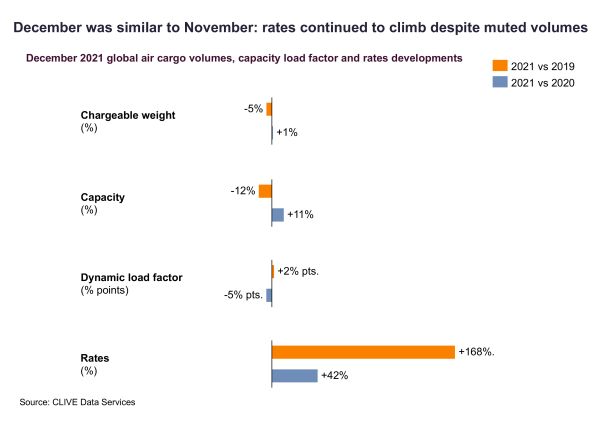

CLIVE’s latest weekly market intelligence shows a -5% fall in chargeable weight in December 2021, compared to the pre-Covid level of December 2019, making it one of the weaker months of the year. Compared with December 2020, volumes rose by +1%.

It said that its data for the fourth quarter of 2021 reflected its earlier statement that the air cargo market was being driven by supply chain challenges, and less so by soaring volumes. In October, CLIVE’s ‘dynamic load factor’ – which measures both the volume and weight perspectives of cargo flown and capacity available to produce a true indicator of airline performance – reported a lower load factor for the time of year than expected, followed in November by a -1.2% drop in volumes.

Cargo capacity has remained slow to return to the pre-Covid level. In December 2021, it remained at -12% to December 2019. The ‘dynamic load factor’ for this December of 65% was +2% pts up versus two years ago.

However, the fourth quarter of 2021 did see major growth in airfreight rates, which in December climbed to 168% ahead of December 2019 (+42% versus December 2020), following earlier monthly gains compared to 2019 of 155% and 159% in October and November 2021 respectively.

CLIVE managing director, Niall van de Wouw, said: “It was certainly more complex to ship goods in 2021 by all modes of transport, which has continued to increase rates. In the general air cargo market, we’ve seen airlines focus more on managing margins than on filling aircraft. From a volume perspective, compared to 2019, November and December did not produce ‘the peak of all peaks’. The capacity and ‘dynamic load factor’ trends were more or less in line with earlier months, but rates kept on climbing.”

He suggests that the December data amplifies what at trend manifested in November, with issues on the ground hitting efficiency. “The rapid increase of Omicron and its impact on staff availability, hard lockdowns and their impact on business and consumer confidence are likely at play here.”

He added: “Looking at 2021 overall, after a very strong start to the year and pretty solid middle months, we witnessed a not-so-strong ending of the year. The wear and tear of close to 20 months of Covid started to really impact the efficiency of the value chain towards the end of 2021, and there are still no fundamental changes expected in the short-term that would change the current dynamics of supply chain shortages and elevated rates.”