The Biden administration’s plan reduce shipments entering the US under the $800 ‘de minimis’ threshold “will not put the genie back in the bottle”, says analyst Niall van de Wouw.

The chief airfreight officer at Xeneta says that Chinese e-commerce platforms are seen as exploiting a loophole in US customs regulations but the real driver of e-commerce is in reality “the massive and seemingly insatiable consumer demand in the West for low-cost fast-fashion, apparel and textiles”.

He argues that Chinese e-retailers such as Shein and Temu were not set up simply because the loophole of de minimis regulations. “More than a billion shipments now enter the US under de minimis exemption each year, with the majority originating from Chinese e-commerce platforms. This extraordinary level of demand is not going away and the genie cannot be put back in the bottle,” de Wouw said.

Xeneta’s latest air cargo market analysis highlighted a 30% annual increase in e-commerce demand ex-China as well as 37 million new downloads of the TEMU app alone in a single month this summer.

There is no clear timeline for the introduction of the new de minimis regulations and van de Wouw believes the Chinese e-commerce businesses will be able to adapt quickly. He said: “Companies like Shein and Temu have known for a long time that changes to US import regulations are inevitable, and I don’t think they will be overly concerned by the latest announcement.

“Even if the new de minimis regulations cause prices to rise slightly on e-commerce platforms, they will still be very low cost. The US Government is trying to level the playing field for American retailers and manufacturers, but the price differential is so big that they aren’t even playing on the same field as Chinese e-commerce.”

Another argument used by the US Government is that the volume of de minimis shipments makes it difficult to target and block illegal or unsafe goods. However, Van de Wouw said: “The US Government has existing regulations at its disposal to stop illegal goods entering the country, they just need to enforce them.

“Stringent checks of every shipment entering the country would cause massive delays and hurt e-commerce businesses far more than any changes to de minimis regulations, but the resources required for this level of enforcement would be very costly. It would also have major repercussions for other businesses importing goods into the US by air.”

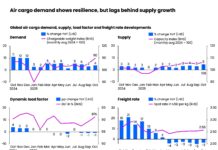

Xeneta says that most e-commerce goods are shipped from Asia to the US by air, with the massive growth in volumes during 2024 squeezing available capacity and causing markets to spike. Its data shows the air cargo spot rate from China to the US in the week ending 8 September rising by 30% year-on-year to US$4.53 per kg.

Van de Wouw warns that the air freight market is set for an extremely challenging year-end peak season when volumes traditionally increase in the run up to Christmas and New Year: “There is a storm coming to the outbound China air freight market. Shippers need to take action now and have a clear plan in place for when the storm hits, such as working with their vendor to minimize the use of spot market capacity, which will likely come at spiralling costs.”