Global air cargo set for double-digit growth in 2024

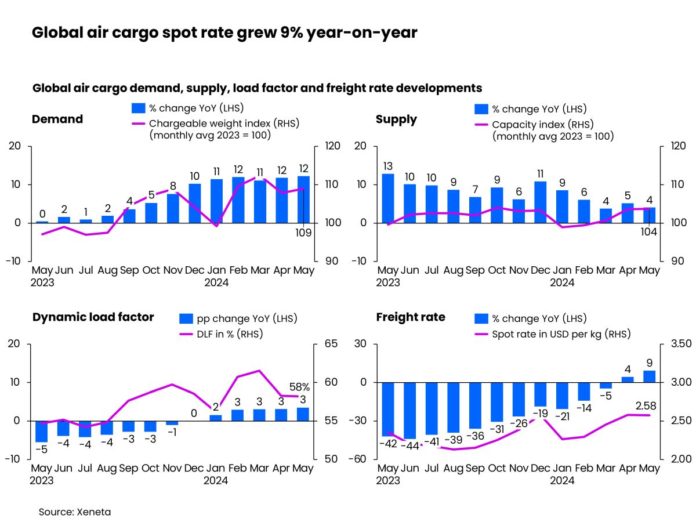

The global air cargo market is on a pathway to double-digit growth in volumes in 2024 after a +12% year-on-year jump in demand in May, according to the latest data analysis by Xeneta.

Despite conservative, low single digit forecasts at the end of last year, expectations have been boosted by six consecutive months of ‘quite extraordinary’ regional demand. The global air cargo spot rate in May consequently registered its second consecutive monthly growth, rising +9% year-on-year to $2.58 per kg, and up +5% pts month-on-month.

Xeneta’s chief airfreight officer, Niall van de Wouw, said: “In terms of growth data, analysts sometimes say ‘once is an incident, twice is a coincidence, and three-times is a pattern’. In the world of air cargo, there’s an undeniable pattern emerging. We can’t use the word ‘surprising’ anymore. When we take a mid-term view of the market, with these kinds of numbers, we might be on track for double-digit growth for the year. It is now a possible scenario.”

While the growth in general spot rate must be measured against a low comparison in May 2023, van de Wouw says the market this year adjusted well to absorb the +5% increase in airlines’ summer capacity.

The highest year-on-year rate increase for May was the +110% rise in the spot rate on the Middle East & Central Asia to Europe corridor, to $3.21 per kg due to continuing Red Sea disruption. Southeast Asia and China to North America spot rates rose +65% and +43% to $4.64 per kg and $4.88 per kg respectively, while China-Europe spot rate also recorded double-digit growth, up +34% year-on-year to $4.14 per kg.

Dynamic load factor in was largely unchanged month-on-month at 58%, but up by +3% pts year-on-year.

How companies see the current market, van de Wouw acknowledged, depends on which region they are active in. Spot rates from North America and Europe to China fell -32% and -23% year-on-year respectively in May to $1.61 and $1.65 per kg. The Transatlantic market also suffered with the corridor experiencing freight rate declines in both the front and backhaul lanes. Increased belly capacity due to summer passenger travel led to drops in air cargo spot rates.

Europe-North America spot rate declined -21% to $1.77 per kg in May versus the previous year, while, eastbound, the North America-Europe corridor spot rate was -16% lower at $1.08 per kg.

Heading towards the second half of the year, van de Wouw pointed to other positive market indicators. A bright outlook for Q4 2024 may be on the horizon following last year’s bumper end-of-year volumes. This may also be helped by a threefold increase of ocean container shipping spot rates from the Far East to North Europe and the US West Coast compared to the previous year, due to port congestion and wider disruption caused by conflict in the Red Sea, reducing the cost gap for shippers or forwarders contemplating a modal shift to air cargo.

A major shift of volume from ocean to air, however, is unlikely, Xeneta says. Compared to the onset of the Red Sea crisis or the Covid pandemic, cost spikes this time around are most likely triggered by shippers frontloading imports ahead of the ocean peak season to eliminate impacts from increased supply chain disruptions.

China’s cargo market to North America continued to gain from the resilient US economy and its strong e-commerce demand. The big question for the air cargo industry is what happens following the US crackdown on e-commerce shipments from there?

Van de Wouw comments: “At the end of 2023 we saw the dramatic impact China’s e-commerce behemoths had on the air cargo market. Everyone is now waiting anxiously to see what happens in the upcoming peak season. But if the potential rising costs and increasing transit times of e-commerce ex-China leads US consumers to procure less and less, that can have a ripple effect globally.

“If fewer freighters are required to carry e-commerce, they will enter the general air freight market (again) and produce a noticeable supply impact, putting downward pressure on rates. This possibility cannot go unnoticed.”