Global air cargo volumes grew +4% year-on-year in April but with the removal of the de minimis threshold for shipments from China into the US on 2 May is expected to dramatically disrupt e-commerce volumes in the coming weeks.

And, with massive uncertainty hanging over the macroeconomic outlook, the question for the air cargo market in 2025 has become ‘how bad will it be?’ says industry analyst Xeneta.

Over the past ten years, US consumers have paid no duty on shipments valued at $800 or less, leading to soaring volumes of cross-border packages into the US of some 1.35bn annually. Similar (but lower) exemptions exist in other countries.

But from 2 May, low-value products sourced from China and Hong Kong into the US will now be subject to new 145% tariffs, or 120% for products sourced from postal services – or a $100 flat fee, rising to $200 on June 1.

Around half of air cargo shipments on the China–US route are e-commerce, accounting for around 6% of global volumes. A sharp drop in demand is likely to challenge carriers’ capacity planning, with early signs already pointing to freighter flight cancellations and potential redeployments to other trade lanes.

One of China’s e-commerce behemoths, Temu, has already responded by dramatically reducing its advertising spend in the US, but the outlook for global air cargo – so dependent on e-commerce income for the last 2-3 years since Covid – extends far beyond the US border, says Niall van de Wouw, Xeneta’s chief airfreight officer.

“This is a double-edged sword. A decrease in demand on one of the key airfreight lanes between Asia Pacific and North America will have a big impact, but so too will the redeployment of capacity on a global level,” he said. “This may be a year when we grow weary of seeing the word ‘unprecedented’ in market performance statements. The macroeconomic picture will depend on how long the uncertainty lasts and what will be at the end of it, but the outlook currently looks quite daunting.

“This is not about one industry being affected. This is about major trade lanes being affected, and we haven’t seen anything on this scale before.”

Weaker market demand in April and downward pressure on rates

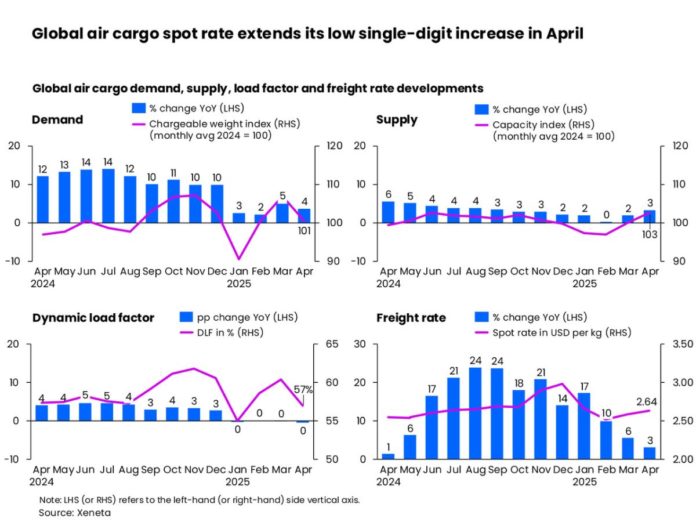

In April, global air cargo spot rates rose just +3% year-on-year, a second consecutive month of only single-digit increases. This slowdown aligns with weaker demand trends. Adding to the downward pressure on rates, jet fuel prices fell -24% year-on-year in the first three weeks of April. This drop, driven by ongoing economic and geopolitical uncertainties, likely played a role in tempering overall spot rate growth.

Meanwhile, available capacity increased modestly, up +3% compared to April 2024, and the dynamic load factor declined three percentage points month-on-month to 57%.

Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

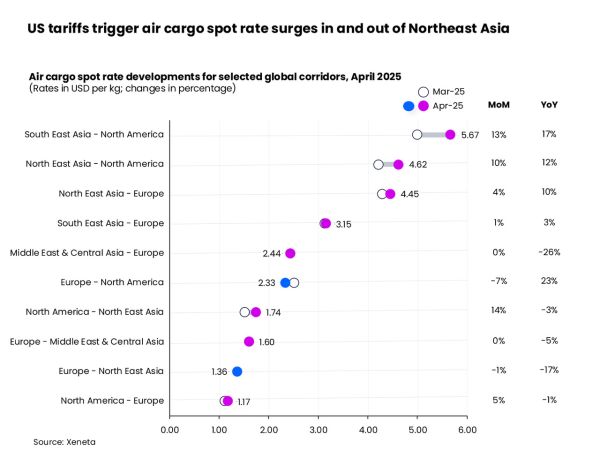

US tariff measures implemented on the country’s so-called Liberation Day on April 2 prompted a rush of air shipments from several Asian countries to North America. This led to double-digit increases in both volume and spot rates. Notably, spot rates from Southeast Asia to North America jumped +13% month-on-month, while those from Northeast Asia rose +10%.

However, these gains began reversing in the second half of April following the announcement of a 90-day tariff pause and +145% retaliatory tariffs on China.

The largest monthly rate surge was observed on the North America–Northeast Asia corridor, rising +14%. This was largely driven by shippers rushing exports to China and Hong Kong amid fears of reciprocal tariffs.

Elsewhere, spot rates between the Middle East, Central Asia and Europe remained flat month-on-month but were down year-on-year, especially into Europe (-26%) , reflecting easing supply pressures from earlier Red Sea disruptions.

Transatlantic westbound rates, meanwhile, declined -7% from March, impacted by increased bellyhold capacity from summer flight schedules, as well as seasonal slowdowns during the Easter holidays and potential US tariff actions.

On the Northeast Asia–Europe corridor, fronthaul rates into Europe saw a slight month-on-month increase and were up +10% year-on-year. However, backhaul rates into Northeast Asia fell sharply, down -17% compared to April 2024, as trade imbalances persisted.

Wait and see

April’s market data failed to provide many indicators for the year because the uncertainly since the start of the month was just ‘pushed back,” van de Wouw said.

“Nothing has really changed in the past month. The global air cargo market is in an intermediate state. It’s very difficult for companies to relocate their sourcing to avoid tariffs, but they are looking at ways to reduce the impact, still not knowing what the final impact might be. The big question for everyone is what will this year do?

“The de minimis change in the US is going to disrupt the market and we’ll see its impact in the May numbers. I would say be prepared for a logistical mess.

“I wonder how many US consumers are aware there was a de minimis rule and that it has now been revoked. But that’s about to change. One industry colleague from Cirrus Global Advisors in the US posted earlier this week that the ‘best-selling’ item from China, a $19.49 power surge protector, was $48.38 in his Temu shopping basket by the time shipping and import taxes had been added. His message, quite correctly, is that the days of free shipping from China are over,” van de Wouw continued.

After double-digit air cargo market demand growth in 2024, forecasts going into 2025 predicted another 4-6% growth year-on-year. Any attempts to reassess the outlook in the current market conditions would be “meaningless,” he said.

“The likelihood of lower airfreight rates are better news for shippers and forwarders but if shippers can’t sell their goods because of tariffs, that’s bad news for the macroeconomic picture and the need for airfreight. For most airfreight shipments, lower rates will not compensate for the tariffs that will have to be paid.

“Therefore, it’s still a waiting game to see how long this process takes and the order of magnitude of which the tariffs will stick,” van de Wouw stated.

Right now, he added, all eyes are on e-commerce.

“This is quite likely the calm before the storm. If the new de minimis set-up remains – and why would they change it after the investment the authorities have reportedly made – then this will undoubtedly negatively impact airfreight volumes from China to the US. The traditional airfreight market will not be able to compensate for the decline in e-commerce volumes.

“Airlines will adjust their networks to this new reality and this, in turn, will have a beneficial impact for shippers around the world as they will see more capacity coming (back) to their market – but they still need viable trading conditions to enjoy the benefit of this opportunity.”