Tension is mounting in the global air cargo market heading into the weaker summer months, says analyst Clive Data Services, part of Xeneta.

It warns that general airfreight rates fell in May to their lowest level since March 2020 as restless airlines and freight forwarders went in search of volumes.

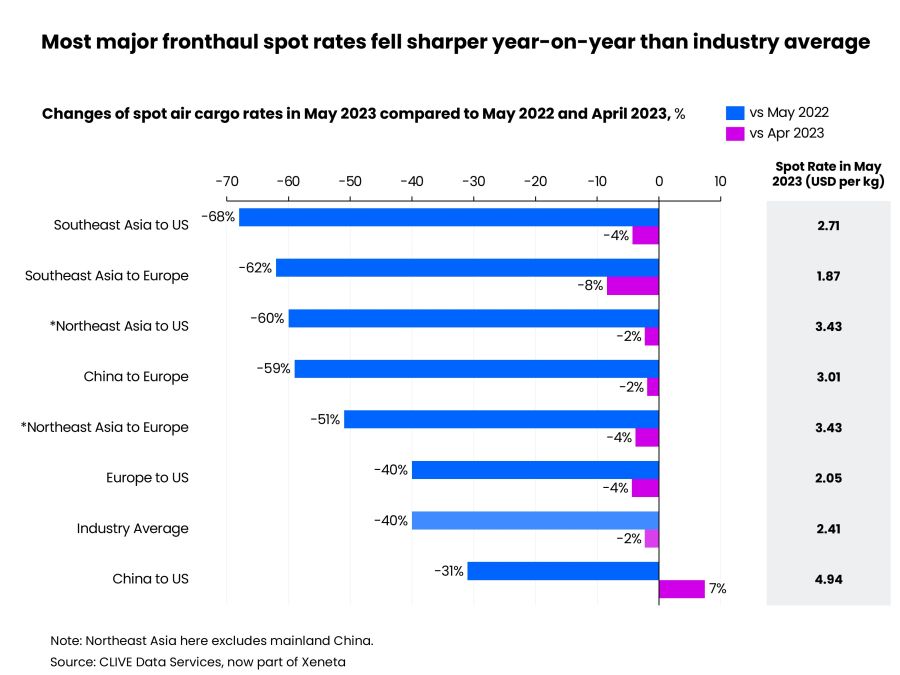

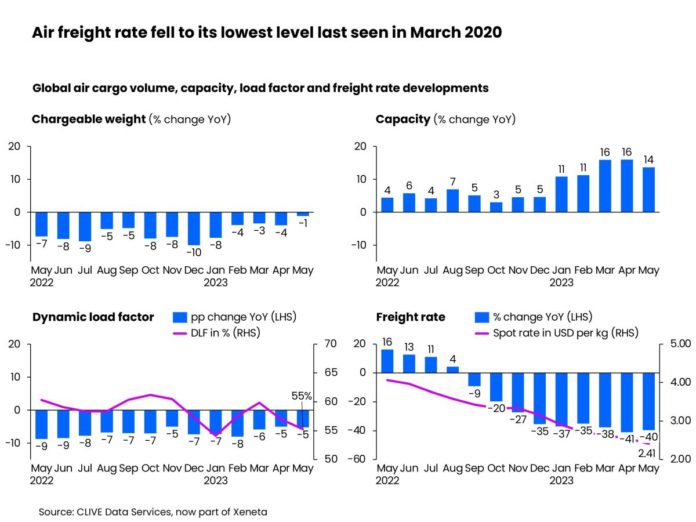

The global airfreight spot rate fell 40% in May from a year earlier, reaching its lowest in over three years of US$2.41 per kg, just days after IATA predicted airline cargo revenues and yields could fall by more than 31% and 29% respectively in 2023.

Softening global air cargo demand saw a less severe year-over-year drop of -1% in chargeable weight in May, the smallest monthly decline in the past 12 months, but the influx of belly capacity for the peak summer leisure travel market applied more downward pressure on rates. Global air cargo capacity in May continued its double-digit increase, up 14% year-on-year.

Less demand and more capacity led to an inevitable fall in dynamic loadfactor, CLIVE’s measurement of global volume and weight perspectives of cargo flown and capacity available. It was -5% pts lower vs. May 2022 at 55%.

Xeneta chief airfreight officer, Niall van de Wouw, said it’s not only rising capacity which is causing restlessness: “There are a lot of ambitious forwarders in the market that want to grow – but they cannot grow with their current customer bases because the airfreight demand is not there, so, as we highlighted in April, they are looking to take a bigger share from someone else.

“At the same time, we see a lot of shippers going to market now because they want to refresh their rates and benefit from the different conditions to 3-6 months ago. Challengers for their business – not the incumbent freight forwarders – smell a chance to buy volumes and are going in and offering low rates. And, whether they get the business or not, the overall rates drop because shippers often stick with their current provider but expect them to adjust their rates accordingly to this lower market level.”

He added: “In my conversations with airlines and forwarders in mid-May, I heard the market was slow, but there was no panic. But the overall market sentiment seems to be changing. Now, more airlines and forwarders are clearly getting nervous, are accepting the fact that hopes of an uptick in peak season demand later in the year are dwindling.”