Seasonally adjusted general air cargo market performance data for July 2022 shows a continued slowing down of volume, load factor, capacity, and rates as economic and political uncertainties hang over the industry, says CLIVE Data Services.

In its latest market intelligence CLIVE Data Services, part of Xeneta, shows volumes dropped -9% in the first month of the third quarter compared to July 2021. Demand was also down -9% versus the same month of 2019. Capacity growth slowed to just +4% over the July 2021 level and was -11% to July 2019. This caused CLIVE’S ‘dynamic load factor’ measure to drop -8% pts year-over-year to 58%, taking into consideration both the weight and volume perspectives of cargo flown and capacity available to produce the most accurate indicator of airline performance.

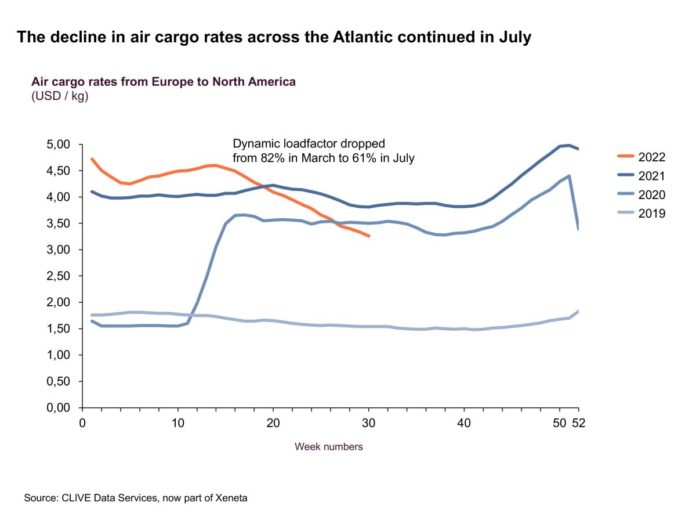

Airfreight rates also continued to fall in July, relative to the June 2022 year-over-year analyses, CLIVE reports, although they remain at +121% versus July 2019 and +11% compared to the same month a year ago.

The slowdown in the global air cargo market since March 2022 is ongoing, said Xeneta chief airfreight officer, Niall van de Wouw, founder of CLIVE and now Chief Airfreight Officer at Xeneta, said there was no let-up in the multitude of disruptions outside of the industry’s control, from the continuing war in Ukraine to the escalating ‘cost of living’ crisis.

Airlines and airports also continue to suffer severe operational challenges due to significant shortages of ground staff.

“There are many dark clouds hanging over the air cargo industry given the state of the world right now. Volumes are subdued, and while air cargo rates are still elevated, they are slowly but surely easing back towards pre-Covid levels. From a rates point of view, indicators suggest the market has yet to bottom out. It’s clear that airlines are following the market very closely to ensure they are deploying their assets in the best possible way because the market is moving quickly. We have already seen freighters moving away from transatlantic routes.

“On the Atlantic, the decline in general airfreight rates we reported for the previous three months of 2022 continued in July. While this will be partly seasonal, the slight increase in load factor across the Atlantic relative to June – from 58% to 61% – might be a result of carriers and forwarders redirecting their freighter operations to other lanes, hence pushing up the load factor for the remaining flights on these routes,” he said.