The air freight market could see a return of “classic seasonality” in 2024, says Oslo-based analyst Xeneta in its 2024 Outlook.

Chief airfreight officer, Niall van de Wouw, said the coming year “could be an opportunity for shippers to catch their breath after the volatility of the past few years. The rapid rate decline which started earlier this year has calmed down in recent months. It seems (that) the market has a new baseline, from which I expect classic seasonality patterns to emerge.”

Airfreight costs skyrocketed during Covid-19 before plummeting again during 2023, although they are still 32% up on pre-pandemic levels.

As with all rollercoasters, a wobbly feeling will remain for a good while after the ride has stopped and air freight continues to be a hugely challenging market, adds Xeneta. It remains as important as ever to understand supply chain data at both a global and regional level.

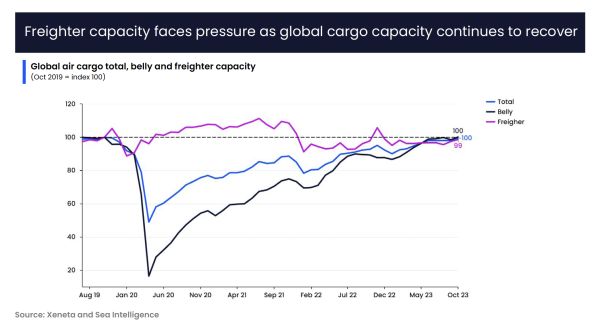

The Xeneta Air Freight Outlook 2024 highlights muted consumer spending as a key factor for the year ahead. Demand for air freight in 2023 remains down by -8% compared to the pre-pandemic figure and is only predicted to grow by 1-2% in 2024. At the same time, supply is expected grow by 2-4% in 2024.

Van de Wouw said: “The key indicators are not great from a demand point of view. It’s muted and there’s a lot of uncertainty in the world. People and companies are a bit more conscious how they are spending their money and we will likely not see demand pick up in any meaningful way in 2024.

“Yes, we will see a return of classic seasonality, but it will be muted seasonality.”

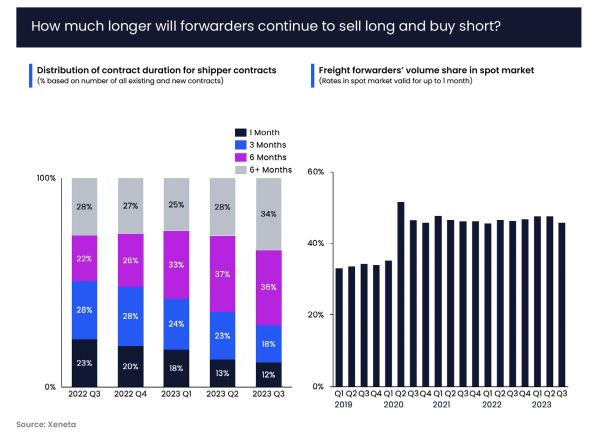

Xeneta data reveals an increasing trend for longer term contracts, but Van de Wouw believes this presents a potentially perilous situation for freight forwarders in 2024.

He said: “There is fierce competition and I understand why freight forwarders want 12 months contracts to secure volumes and shippers want to lock in for a longer period to reduce their workload.

“The problem is freight forwarders are selling long term contracts but buying the majority of volume from carriers on the short term spot market. If the rates go up, there is a serious issue.

“We saw it recently out of Vietnam where 70% of volume is bought on the spot market. Rates suddenly went crazy prior to Golden Week and freight forwarders told shippers they could not honor the contracted service.

“This could happen in any market and is a real risk for next year unless freight forwarders and airlines can find common ground on long term rates.”

The Xeneta Outlook 2024 also predicts that the continued recovery of capacity will put downward pressure on rates, along with environmental sustainability and improving schedule reliability in ocean freight shipping.

Has the rollercoaster really come to a halt or are there more twists and turns yet to come?

Van de Wouw said: “At Xeneta I have learned how incredibly important it is for the air freight industry to look towards the ocean.”

With 97% of global containerized goods transported by sea: “Given the volumes involved, if the ocean industry mess things up, even to a small degree, then there is always money to be made in the air.

“Reliability in ocean is improving, but it only takes one black swan event for the situation to change and rates to increase rapidly.

“No one has a crystal ball, but you only have to look at the drought in the Panama Canal, threat of volcanic eruptions in Iceland and conflict in the Middle East to understand how delicate and sensitive to world events the air freight industry is.

“If we do get a black swan event in 2024 then strap yourselves in for another ride on the rollercoaster.”