United Airlines will restart New York Newark to Tel Aviv flights on March 15, with a second daily flight planned to begin March 29. It follows a detailed assessment of operational considerations for the region. The flights will be operated by Boeing 787-10s.

ACS remembers the day of the Tsunami

Twenty years on from the Tsunami that devastated communities in the Indian Ocean on 26 December 2004, UK-based broker Air Charter Service has released a short video on one of the longest, largest and most complex relief operations in its history.

The response involved virtually every person in the cargo division of the company at the time, along with other divisions, and many of those that played a part are now senior figures at ACS. Over the course of the relief effort, which lasted several months, it arranged over 100 charter flights, along with daily missions on cargo helicopters.

Some of the unique challenges that ACS, and other relief organisations faced, included a lacking of handling facilities at airports in the region and a badly damaged road network, making onward transport virtually impossible.

Early in the operation Dan Morgan-Evans, now group cargo director, was seconded to work in the British Government’s Whitehall headquarters to help coordinate aid efforts. From there he coordinated an extensive response, including transporting a highloader to open Medan airport to larger freighters, and transporting Super Puma helicopters from Europe to operate daily missions for the UN to deliver aid to the badly hit coastal towns, that were inaccessible by road.

James Leach, now chief marketing officer, was on the ground in the region and was instrumental in finding a base for the helicopters on an island just north of Banda Aceh. Elsewhere in the region, Richard Thompson, now president of ACS Americas, flew to the Maldives on a flight carrying nothing but 40 tons of water. Other aid flown in included medical supplies, shelter equipment and offroad vehicles.

Ben Dinsdale, who was part of the ACS effort 20 years ago, and is now ACS’s director of government and humanitarian services, said: “We’re extremely proud of being able to respond to humanitarian disasters in this way – this work makes up a huge part of ACS’s history.”

Indian Ocean Tsunami 2004 | ACS Humanitarian Response Retrospective

Slow start to the year as air cargo plays a waiting game

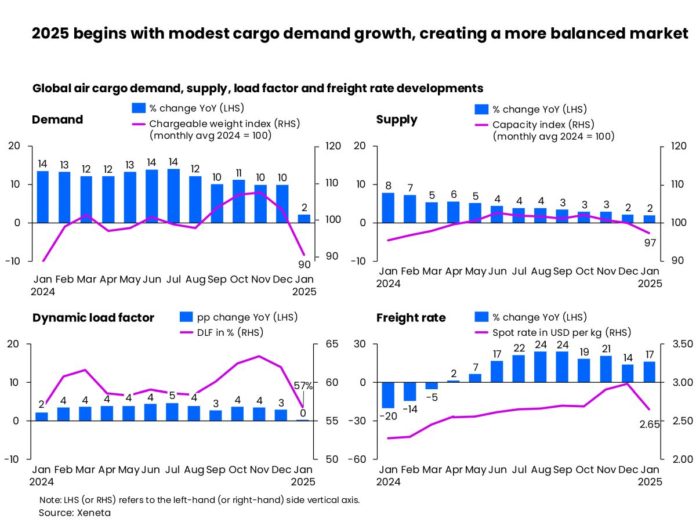

This year – 2025 – began with lower-than-expected growth in global air cargo demand in January of just +2% year-on-year compared to the double-digit monthly increases throughout last year but fears of a trade war over tariffs impacting volumes and growth forecasts for the year are premature, say industry analysts Xeneta.

January’s data was impacted by the earlier Lunar New Year reducing volumes out of China, but the big drop in demand was still as a surprise, says Xeneta’s chief airfreight officer, Niall van de Wouw.

However, he sees no immediate reason to change Xeneta’s +4-6% growth forecast for global air cargo in 2025 despite the market’s nervousness over new tariffs introduced by the US – particularly on China -and their subsequent retaliation.

“The lower growth in air cargo demand in January was not down to President Trump, nor, entirely, the earlier Lunar New Year. It also compares to an unusually high comparison in January 2024,” van de Wouw said. “Nonetheless, the air cargo market in entering a period of uncertainty, which makes planning extremely challenging.

He says that implementation of tariffs by the US and the response of China, Canada, and Mexico are just the start of a negotiation. “We could end up in a global trade war, but in the case of President Trump, we have someone who’s ready to negotiate everything and the rest of the world can influence the outcome, as we have already seen. The consistency here is he’s looking for a deal,” van de Wouw said.

“We don’t know what will happen, but we do understand that uncertainty is not good for trade confidence, and it doesn’t help investment. People like to see some kind of stability before they put their money down. If I was a shipper, I would not be rushing to make too many plans or take any drastic measures. I’d have my team ready to do things differently, but I’d wait to see what actually happens because, right now, there’s a lot of sabre rattling and noise but little clarity.”

E-commerce volumes

Cross-border e-commerce demand was one of the main pillars fuelling global growth in air cargo volumes since Q3 2023. Is this now at risk?

In 2024, China cross-border e-commerce shipments to the US accounted for 25% of its total global sales – and filled over 50% of cargo capacity from China to the US. Suspension of the de minimis exemption could, therefore, have a profound impact on air freight capacity between China and the US and beyond by prohibiting import shipments, increasing costs, and adding time-consuming entry filing requirements and potential customs delays.

Van de Wouw said: “E-commerce volumes out of China grew +20-30% last year, following similar growth in 2023, so it’s going to take a sledgehammer to crack that level of consumer demand and I’m not sure blocking de minimis alone is enough. China e-commerce was not set up to take advantage of de minimis loopholes – it has taken advantage of consumer demand for cheap, fast goods.

“E-commerce products may be slightly more expensive if de minimis is removed, but they will still be cheaper than buying through retailers in the US – but delays in receiving the goods due to operational disruptions could have a bigger impact than price because it takes away the attractiveness for consumers,” he added.

China’s e-commerce giants also knew this day would come and will not allow a business model on this scale to collapse due to de minimis, van de Wouw argued. “Even if de minimis is being blocked, the e-commerce retailers will still keep selling and shipping the goods. There may not be a significant impact on air freight rates in the short term in this scenario, even if it causes chaos at the receiving airport in the US.”

In the longer term, demand for e-commerce – and therefore freight rates – will only be impacted if the consumer feels the cheap price is not worth it if they face a longer wait to receive their goods. “In this scenario, we’d expect to see a major downward impact on freight rates at a global level – but to predict this now would be to ‘cry wolf’. Let’s wait and see. Maybe nothing changes,” he said.

Van de Wouw says the winners of any muted growth in e-commerce volumes will be general freight shippers globally as capacity is deployed elsewhere, placing a downward pressure on rates in these new markets. But, general air freight demand has recorded no real growth in recent years and there’s little expectation of any significant upturn in its fortunes in 2025, he cautioned.

January performance

Global air cargo chargeable weight in the first month of the year grew just +2% year-on-year, influenced also by the diminishing impact of ocean shipping disruptions.

As anticipated, global air cargo capacity showed a similarly modest growth of +2% in January, lowering the dynamic load factor to 57% in January, on par with a year ago. Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

Nevertheless, global air cargo spot rates in January remained +17% higher than a year ago, reaching USD 2.65 per kg and +56% above pre-pandemic 2019 levels. These elevated rates can be attributed to the e-commerce boom, limited air cargo capacity from slow aircraft production, flight rerouting due to Russian airspace closures, and the delayed adjustment of freight rates to supply-demand changes.

Month-on-month, January’s global air cargo spot rate fell -11%, a slower decline compared to the same period a year ago (-13%).

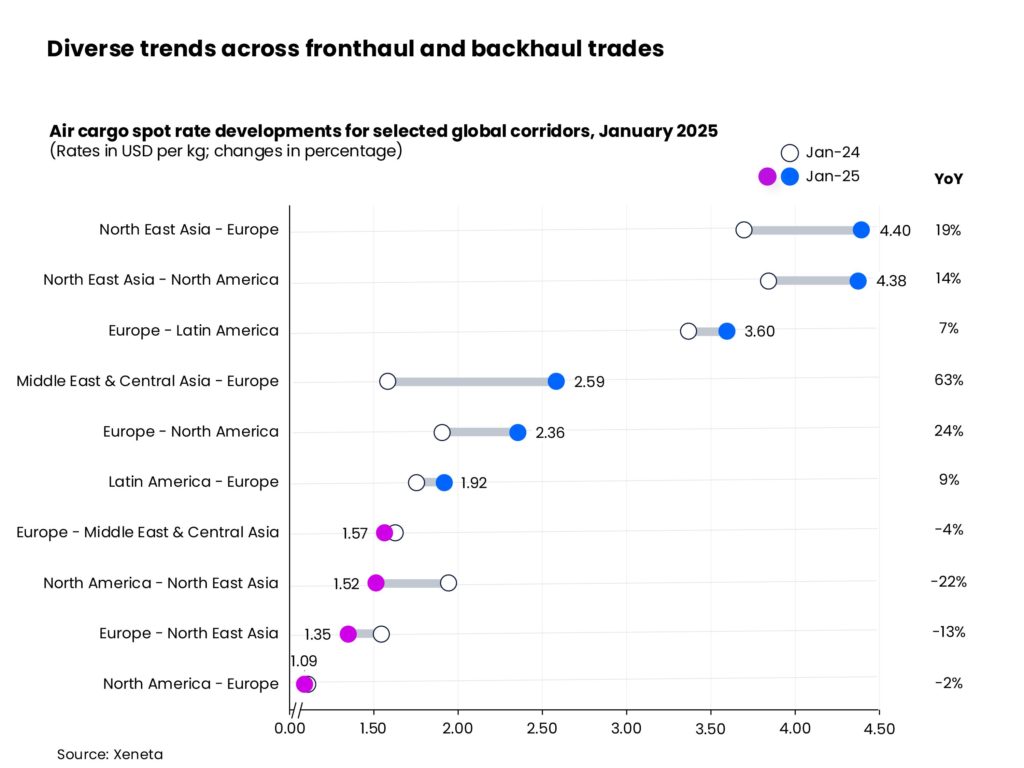

In terms of corridor trends, major global corridors continued to rise year-on-year in January. The largest increase was seen in trade from the Middle East and Central Asia to Europe, with the air cargo spot rate surging +63% from a year ago to US$2.59 per kg, driven by ongoing Red Sea disruptions. This was followed by the Europe to North America corridor, where the spot rate grew +24% year-on-year to $2.36 per kg.

A strategic shift in freighter capacity towards Asia-related trades contributed to moderate rate growth from North East Asia. Spot rates from North East Asia to Europe increased +19% to $4.40 per kg, while rates to North America rose +14% to $4.38 per kg.

In contrast, backhaul trades on these corridors saw spot rate decline due to growing trade imbalances: ranging from -22% on the North America to North East Asia corridor to -2% on the North America to Europe corridor. The only corridor where air cargo spot rates grew in both directions was between Europe and Latin America, with high single-digit year-over-year increases.

Prestwick wins first Far East carrier

Hong Kong Air Cargo will become the first Far East airline to launch flights to Glasgow Prestwick Airport in Scotland, UK. The first flight on 11 February will be an Airbus A330-200F operating from its home hub, with additional flights already planned for 18 and 25 February.

The first flights will be carrying shipments from three of the top four e-commerce platforms – SHEIN, Temu, and TikTok – all of which operate out of Hong Kong. Each flight will carry up to 60 tonnes, which will be processed and sorted at PIK before final mile delivery by Royal Mail Group and EVRI.

The airport is working with Scottish exporters to fill the return leg with Scottish salmon and whisky and is collaborating with trade associations to increase exports flying out of PIK, avoiding the need to truck goods south.

Astral Aviation appoints GSAs for US, Europe, and China

African cargo airline Astral Aviation has appointed Network Aviation Group as its general sales agent (GSA) for the US, Europe and HIT Cargo Asia as GSA for mainland China.

Network Aviation will strengthen the carrier’s operations and provide tailored cargo solutions and access to Astral Aviation’s network.

Astral chief executive, Sanjeev Gadhia, said: “Their deep understanding of the air cargo industry and their commitment to excellence make them the ideal partner to represent our interests and serve our customers in these key markets.”

Group sales director for Network Aviation, Andy King, added: “We have over 40 years of experience, in providing air freight solutions for clients in the East African region and look forward to growing this business together with Astral.”

Germany’s Arvato acquires US firms

German logistics service provider Arvato has acquired US-headquartered companies Carbel LLC and United Customs Services. Carbel is a full-service 3PL provider with a strong focus on fashion and retail, providing custom warehousing, distribution, storage and transportation services at six facilities in the US.

United Customs Services provides import and export solutions and specializes in remote location filing in the US, customs clearance and trade compliance.

Arvato aims to expand the range of services and expand its customer base, particularly in the fashion, beauty and lifestyle sectors.

It follows Arvato’s recent acquisition of ATC Computer Transport & Logistics, which specializes in high-security transport and technical services in the data center industry.

In the US, Arvato will have a total network of 16 warehouses with about seven million square feet (650.000 m²) of warehouse space after the acquisition.

Lufthansa JFK gains CEIV Pharma certification

Lufthansa Cargo’s New York JFK station has gained IATA CEIV Pharma certification. The facilities there are equipped with walk-in refrigerators (2 to 8°C), walk-in freezers (-10 to -20°C) and temperature-controlled storage areas (15 to 25°C. Lufthansa Cargo now offers over 28 CEIV-certified and five GDP-certified stations as well as CEIV Pharma certification as an airline.

WFS opens JFK’s first new cargo terminal in 30 years

Worldwide Flight Services (WFS), a SATS company has opened the first new cargo terminal to be built at New York’s John F. Kennedy International Airport (JFK) in 30 years.

WFS’ warehouse footprint at JFK now exceeds 1 million square feet across eight facilities, reinforcing its position as the airport’s largest provider of cargo handling services. The handler currently serves 38 international and domestic airline customers at JFK.

With 350,000sq ft of floor space, Building 260 increases WFS’ cargo capacity at New York JFK by a further 25% and establishes the first-ever dedicated on-airport handling facility for temperature-controlled pharmaceutical products and perishable cargo with over 3,000sq ft of cooler space at between 2-8°C or 15-25°C.

There is an adjacent ramp area that can accommodate up to three Boeing 747-400/777 or similar-sized wide body freighters and has already received its first arrival with Atlas Air.

Safety features include dock and polymer barriers to prevent accidental trailer movement, as well as impact-resistant doors and column protection systems to minimize damage from forklifts and moving equipment.

A Dock Management System is expected to reduce truck dwell times by as much as 25% by generating pre-alerts to reduce air waybill processing time and a Slot Booking System will manage traffic flow and provide clear visibility of shipment movements and availability, allowing WFS to schedule truck appointments at the building’s 44 truck docks based on shipment volume and complexity.

Warehouse Progress Monitoring (WPM) gives customers real-time visibility, Auto Dimensioning Equipment compliance with carrier requirements, and IATA Dangerous Goods (DG) Autocheck boosts safety and security. The Automated ETV (Elevating Transport Vehicle) and Unit Load Device (ULD) Management systems have been designed to allow for tracking by flight and automated staging for cargo buildup and breakdown, which helps to streamline operations by minimizing forklift usage needed to move ULDs like aircraft containers and pallets.

Building 260 is also close to several major highways.

Sustainability solutions include electric forklift trucks and electric vehicle charging stations for ground support equipment and customer or employee vehicles.

WFS chief executive for Gateway Services, Americas, Mike Simpson, said: “Building 260 marks a new era for WFS and air cargo at one of the main gateways to the US. This cutting-edge facility reflects our commitment to innovation, sustainability, and operational excellence in our drive to serve customers better.”

CMA CGM joins online platforms

CMA CGM Air Cargo capacity is now available on the Cargo.one digital procurement and sales platform. Forwarders in the US, Germany, France, the Netherlands, Belgium, and Italy, can now use it to book the French-owned carrier’ services which operate from Greater China and North America and between various European gateways and Asia.

CMA CGM Air Cargo has also joined CargoAi’s CargoMart freight management platform, giving customers access to a comprehensive network of routes. One feature of the platform is the ability to compare flight options by carbon emissions, track CO2 emissions at a shipment level, and purchase sustainable aviation fuel (SAF) when required.

Finally, the French carrier has joined the Freightos WebCargo and 7LFreight cargo booking platforms. Forwarders can now access its global air freight network, see real-time rates and eBook cargo on key trade lanes connecting the US, France, Italy, Spain, and Asia.

Hellmann buys out US perishables partner

Hellmann Worldwide Logistics has acquired all shares in HPL Apollo, its perishable logistics joint venture previously co-owned with Mercury Aviation, its partner of the past 12 years. Headquartered in Los Angeles, HPL Apollo specializes in the transportation of perishable goods by air, sea, and road. Ivo Skorin, who has been with HPL Apollo since 2012, will continue to act as managing director of HPL Apollo.

Hellmann has offered perishable logistics across the Americas for decades, in markets such as Peru, Mexico, Brazil, and Chile and will now focus on expanding its presence in the US, where it already operates in locations including Miami, Los Angeles, Honolulu, and San Francisco. It also plans to enter new strategic markets such as Colombia, Ecuador, and Central America in the coming years.