The global air cargo market’s surprisingly positive start to 2024 continued in February with a second consecutive month of double-digit demand growth and an uptick in general freight spot rates, said analyst Xeneta in its latest weekly market analysis, published on 6 March.

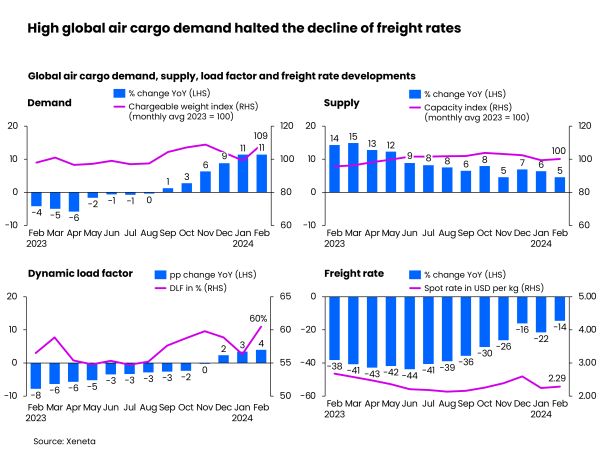

Following January’s 11% growth in volumes, February saw a similar upward curve for airlines and freight forwarders with demand increasing +11% year-over-year. Reflecting this improvement, in what is traditionally a slower time of year for airfreight volumes, the average global cargo spot rate in February rose +2% from the previous month to US$2.29 per kg.

This increase is unusual compared to pre-pandemic trends during the same periods, when air cargo spot rates tended to decline following the previous year-end’s peak season, and in the period immediately after the Lunar New Year, before rebounding towards the year-end holiday seasons.

Xeneta chief airfreight officer, Niall van de Wouw, said: “It’s a surprising start to the year from a volume perspective, and not something people would have expected, ourselves included, with demand much higher than it was a year ago. Generally, we wouldn’t expect to see a rate uptick at this time of year. This is likely related to the Red Sea disruption, but this is not the only factor.”

He continued: “Signals suggest inflation is not cooling because consumers are still spending. It’s not how much they are spending that’s boosting airfreight, it’s where they are spending. Trends indicate more consumers are buying on e-commerce platforms and the intercontinental nature of these businesses, as well as the speed with which they are expected to deliver, is benefiting air cargo. For some airlines, e-commerce now makes up over 50% of their revenue ex East Asia.

“We now wait to see what impact the airline’s summer schedules will have as well as what happens next in the Red Sea. We would certainly expect to see downward pressure again on rates once the summer belly capacity returns in the western hemisphere as well as China, where the travel recovery is by no means yet done,” he said.

Growth in global air cargo traffic in February, measured in chargeable weight, rose +10% month-over-month, pushing the dynamic load factor up by four percentage points to 60% in February, while global air cargo capacity remained relatively unchanged from the previous month.

The increase in the average general cargo spot rate in February, as well as the upward trend in volume for the first two months of 2024, was most likely driven by the substantial growth in demand caused by Red Sea shipping disruption and e-commerce demand from China.

Some operators even imposed short-term embargoes on import traffic ex Asia during February to help clear backlogs caused by the sudden surge as demand growth outpaced the growth of global cargo supply (+5% year-on-year) for the fourth consecutive month.

Consequently, the year-on-year decline of the global air cargo spot rate was at its lowest since October 2022 in February at -14%.

The continuing Red Sea conflict continues to impact ocean container shipping, producing a positive spill over modal shift in favor of air cargo. Recent declines in ocean container spot rates were also impacted by a drop in ocean schedule reliability for Asia to Europe trades, which was 39.4% in January, the lowest since October 2022, according to Sea Intelligence. This has further contributed to the strong increase in air cargo demand on this corridor for shippers willing and able to bear the higher cost of airfreight to maintain their supply chains.

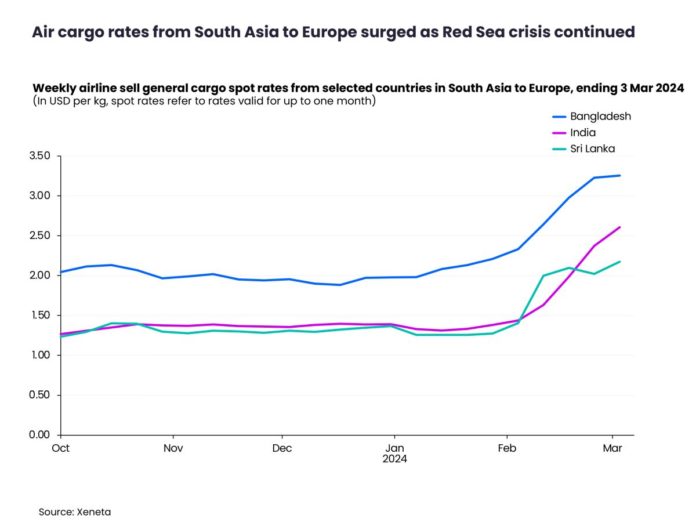

In February, the South Asia to Europe market led the month-over-month growth in spot rates. The Red Sea events caused air cargo demand on this trade to rise by +18% from the previous month, lagging one month behind the demand growth for the China and Vietnam to Europe markets. Consequently, the average spot rate from South Asia to Europe increased by +34% month-over-month to $2.15 per kg in February.

Looking at the general cargo market at a country level, India, Bangladesh, and Sri Lanka experienced significant increases in their general cargo spot rates, which rose by +81%, +40%, and +55% respectively in the week ending March 3 compared to four weeks earlier, driven by strong demand for apparel from these countries.

Similar to the outbound South Asia market, the average spot rate from China to Europe rose by a more modest +11% month-over-month to $3.67 per kg in February – but, the week-long Lunar New Year holidays caused a -9% decrease in the spot rate to $3.47 per kg in the week ending 3 March.

The air cargo spot rate from China to the US of $4.12 per kg in February was up +15% from January as spot rate changes stabilized throughout the month. In the week ending March 3, the spot rate fell by only -2% from its peak in the week ending February 11, to just one cent below its monthly average of $4.12 per kg.

As the rise of cross-border e-commerce continues to drive demand for air cargo, particularly from Guangzhou and Hong Kong, market intelligence indicates some shippers transiting these locations are now starting to use alternative hubs to circumvent capacity constraints caused by the e-commerce boom.

Van de Wouw said: “Our conversations with shippers suggests many are looking to derisk their supply chains by avoiding hubs which are now so dominated by e-commerce behemoths. This comes down to simple math for shippers. If you’re a clothing retailer, with spring on the way in Europe, you want your seasonal products in-store for the peak demand period. If they’re stuck in a sea container because of longer lead times, and you miss this opportunity, the subsequent mark down in the product cost is likely greater than the cost of switching from sea to airfreight.

“This is shaping the market – but we also know the market will probably surprise us again in the coming weeks.”.

Compared to the other corridor, Europe to US air cargo spot rates saw the smallest month-over-month growth of +5% to $2.05 per kg in February.

Airlines, forwarders, and shippers will now be closely monitoring market trends as carriers prepare to launch their summer schedules at the end of March. This will specifically impact the transatlantic air cargo market, which normally sees a capacity increase of about +50% due to increased belly space during the peak summer months for passenger travel.

As in previous years, this is expected to put downward pressure on air cargo rates on Europe-North America corridors, as well as flows that use European hubs as transit points, such as those in the Indian subcontinent and Southeast Asia markets to North America.

(Xeneta’s year-over-year analysis accounts for the 29-day month of February 2024.)