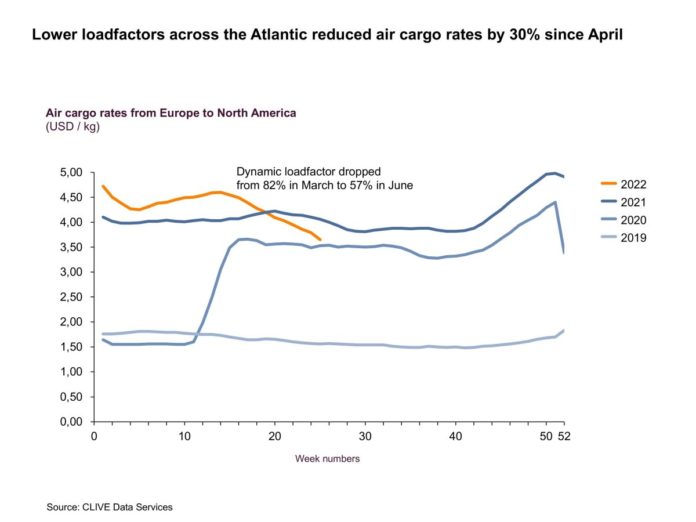

Extra summer airline capacity put downward pressure on freight rates, especially on the North Atlantic which has seen a 30% decline over the past three months, said CLIVE Data Services, part of Xeneta.

Global air cargo volumes fell again in June, down 8% year-on-year, added the industry analyst.

Demand in the general airfreight market in June was also down 7% compared to 2019 and follows the 8% drop in volumes reported by CLIVE for May 2022.

Available cargo capacity in June rose 6% over the same month of 2021 but remained -11% down on the 2019 level. CLIVE’s ‘dynamic load factor’ for the month was 59%, 9% lower than in 2021 and 2% adrift of June 2019.

However, general airfreight rates in June were 129% higher than in 2019 and 13% higher than in 2021. Although this continues the decline seen on a global level in recent months, the drop slowed relative to May.

Xeneta chief airfreight officer and CLIVE founder, Niall van de Wouw, said: “In our analysis of air cargo market performance in May, we said the North Atlantic market could provide ‘a test case for the direction of other markets once they also return to their pre-Covid levels.’ This is still true, and we may see the consequences sooner than we anticipated a month ago. General North Atlantic airfreight rates dropped by around 30% between the first week of April to the last week of June.

“This brings these rates very close to the 2020 levels. If we just look at the Spot market, the rates are already lower in the last two weeks of June 2022 compared to 2020 by around 5% and the market has yet to bottom out. This will be causing some interesting soul-searching for airlines and forwarders.”

He added that will flights from Asia to the US and Europe remain relatively full, there could be a knock-on effect from the softening air cargo market? Carriers could deploy their freighters to other markets in Asia Pacific, Africa, or South America.

Niall van de Wouw added: “It will also be interesting to see the reaction of forwarders that have secured air cargo capacity directly with airlines or through charter brokers or ACMI providers because, in a softening market, more options are available. They were willing to pay a price for reliability and their own control, but they may now be considering how much cheaper it could now be to use commercial airline capacity. And, has the ‘cost of living’ crisis even started to kick-in yet?”

Rising cases of Covid will be another market concern, he said, as is the continuing struggle to tackle the people drain in the aviation and logistics industries. He pointed to reports of restrictions on freighter operations at Frankfurt Airport due to labour shortages as well as the recent study by IRU, the international road transport, which shows 2.6 million truck driver vacancies went unfilled in 2021 and forecasts a worsening situation in 2022.

Relatively low wages and poor working conditions for some workers on the frontline of supply chains, van de Wouw said, means “we won’t see this struggle disappear anytime soon.”