American Airlines Cargo has promoted Andy Cornwell head of cargo sales for Europe, Middle East and Africa. In a 35-year career with the carrier, he has held various positions in sales and business development. He will continue to be based at London Heathrow from where he will report to global head of sales, Indy Bolina.

Air Canada flights restart

Air Canada is gradually restarting its operations after agreeing to mediation with 10,000 flight attendants, members of the Canadian Union of Public Employees. Discussions were begun on the basis that the union commit to have the airline’s 10,000 flight attendants immediately return to work, after Air Canada and Air Canada Rouge flights were grounded on August 16.

The first flights are scheduled for the evening of August 19, but return to full, regular service may require seven-to-ten days as aircraft and crew are out of position. Some flights will be cancelled over the next seven to ten days until the schedule is stabilized.

Leman offers sea-option between US and Europe for furniture firms

Danish forwarder Leman is offering a direct connection between the US and its Northern Europe logistics hub in Taulov, Denmark, aimed at lifestyle products such as furniture, and interior furnishing and other goods requiring special handling. It combines dedicated ocean freight capacity with air freight.

Located in the heart of Denmark’s Triangle Region, Taulov offers direct connections to Northern and Central Europe. The hub features temperature-controlled storage, and handling procedures tailored to high-value products, supported by digital tracking, customs clearance, and value-added services.

Leman operates around 40 offices across Europe, North America, and Asia, providing global transport solutions within road, sea, and air freight, as well as warehousing, customs clearance, and tailored logistics services for key industries including Pharma, Retail, and Lifestyle.

IAG Cargo keeps asparagus coming

IAG Cargo has reported a 21% year-on-year increase in perishable volume in the first half of 2025, particularly from Peru due to a shift in European consumer behavior.

In March alone, year on year asparagus exports from the country surged by 105%, with Spain among the top destinations during the off-season in Europe.

IAG Cargo says that the expansion of its perishables handling facility in Madrid in April 2024 has created a key hub for efficiently managing fresh produce.

Regional commercial Americas at IAG Cargo, Rodrigo Casal, said: “By keeping fresh goods moving, we’re also connecting producers with new markets, strengthening local economies, sustaining livelihoods, and creating opportunities across the supply chain.”

General manager of Lima-based exporter Peak Quality, Carlos Aparcana, added: “Lima-Madrid route is essential for our supply chain, connecting us directly with our key markets in Europe. During our high season from September to December, we handle up to 30 tonnes of asparagus a day. Working with IAG Cargo gives us the reliability we need to meet global demand and tight deadlines.”

Online insurer breezes into US market

The Breeze cargo insurance platform has entered the US market with a collaboration with Great American Insurance Group

Great American, an A+ (Superior) rated provider, will expand Breeze’s capacity to integrate fully with freight forwarders’ workflows, offering instant quotes and coverage

Breeze chief executive Eyal Goldberg said: “Partnering with Great American gives us the scale and strength to deliver on that promise across the US. With Great American’s backing, Breeze can now offer seamless, fully embedded cover, backed by one of the strongest underwriters in the market.”

Wisor integrates Quote & Book

Tel Aviv-based freight automation platform Wisor.AI has integrated CargoAi’s Quote & Book API from its CargoCONNECT suite. It enables Wisor users to access live airline pricing and booking capabilities directly from within its intelligent freight management platform.

It gives real-time access to over 105 airlines, 680 schedules, and 2.5 million dynamic rates with instant booking capabilities, eliminating manual quote requests.

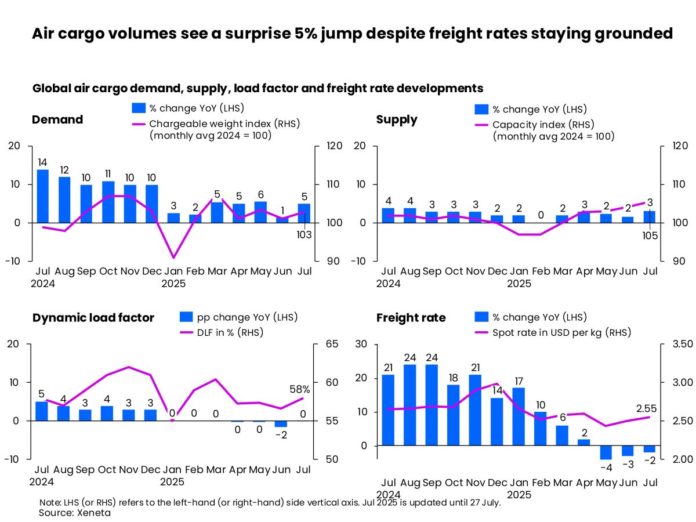

Trump effect boosts July air cargo

Global air cargo volumes jumped by 5% year-on-year in July as more shippers opted for the speed of airfreight to help circumvent US tariffs, according to the latest market analysis by Xeneta.

Market sentiment, however, remains subdued as tariff talks in Washington continued. The lack of clarity continues to cast a shadow over global trade flows, particularly in the airfreight sector.

Contrary to the usual seasonal lull, July saw a notable upturn in global air cargo demand following a modest +1% gain in June. This unexpected boost, bucking seasonal patterns, appears driven in part by tariff-related frontloading, mode shift, and persistent uncertainty, prompting businesses to expedite shipments.

With cargo capacity in July increasing by a lower level of +3% year-on-year, the more robust +5% rise in volume helped lift the dynamic load factor, which has now returned to levels comparable with a year earlier (58%) and recovering the -2% point decline recorded just a month ago.

Xeneta chief airfreight officer, Niall van de Wouw, said: “As we said earlier in the year, air cargo is piggybacking on the chaos being caused by tariffs. While the growth in July will come as a pleasant surprise to many, this growth is not a consequence of increased trade. It is a sign of the creative ways companies are trying to circumvent the higher costs of tariffs.

“What we are seeing currently is mode shift and that is helping the airfreight market in the short-term. If you’re trying to circumvent tariffs, you’re going to want to do it fast, and a plane is faster than a ship. Having goods in an ocean container for 30 days will feel like a very long time for a lot of businesses right now.

“Businesses are getting creative to try to avoid or lessen the impact of tariffs. It’s a game of ‘cat a mouse’ between the US administration and companies,” he added.

Spot rates decline for a third month

Despite firmer fundamentals, global air cargo spot rates declined for a third straight month in July, falling -2% year-on-year to US$2.55 per kg. Yet the rate of decline has eased, thanks to the resurfacing demand-supply imbalance. A modest +2% month-on-month uptick in July offered a glimmer of relief to airlines, although the mid-term trajectory remains muted.

Notably, the gap between seasonal rates (valid for over one month) and spot rates (valid for up to one month) has widened – from 5 cents below spot rate in late May to more than 20 cents below by the end of July, indicating subdued mid-term confidence.

Further complications loom. The US is preparing to end the de minimis exemption for all countries by the end of August, a policy shift that could reshape small-parcel air trade. Since 2 May, the exemption has already been removed for shipments from mainland China and Hong Kong, which collectively account for an estimated two-thirds of all de minimis parcels entering the US, according to US Customs and Border Protection. This resulted in a reported -50% drop in China’s low-value and e-commerce exports to the US in June, based on the latest China Customs statistics.

The broader rollback will primarily affect Canada, the UK, and Mexico – countries that together make up most of the remaining one-third of affected volume. Potential disruptions to US postal services, governed by international treaties, could add yet another layer of complexity, as reciprocal measures from foreign postal authorities remain a distinct possibility.

While the lack of detail around tariffs is “creating a tremendous lot of headaches for people”, van de Wouw acknowledged, it is, once again, pushing up airfreight volumes. “Circumventing is about responding quicker, anticipating something else, and being prepared to pay a little bit more for airfreight transportation because it is still better than paying a much higher tariff on goods,” he said.

Chaos benefits airfreight

“When there is a mess and chaos in international trade, it is to the benefit of airfreight, as we have seen before. And, right now, we have it on an unprecedented global scale,” van de Wouw states. “Yes, tariffs are only to and from the US, but the lack of clarity is affecting a lot more trade lanes as companies try to reduce their financial risk.”

This continuing uncertainty, he said, is “one of the few things that might protect air cargo demand in the coming months because hardly anything has been finalised in relation to tariffs. Businesses are seeing the news headlines and intentions, but not the details and commitments. And we should not forget that when commitments are made, this won’t be by the entities that will need to fulfil them.”

Airfreight rates along the transpacific corridor weakened markedly in July. Spot rates from Southeast Asia to North America fell by -16% year-on-year to US$4.87 per kg, as earlier capacity constraints eased. In contrast, rates from Northeast Asia to North America remained relatively flat at $4.81 per kg, buoyed by robust demand out of Taiwan. There, spot rates climbed +9% year-on-year to $6.85 per kg, fuelled by surging appetite for AI and semiconductors.

Mainland China, however, told a different story. Spot rates to the US declined by -11% to $4.26 per kg, weighed down by both the de minimis ban, heightened tariffs, and market uncertainty.

China-Europe e-commerce surge

On Asia-Europe routes, spot rates from Northeast Asia to Europe held steady at $4.16 per kg. Yet beneath that calm surface lies a reshuffling of capacity: a notable shift of freighter capacity from the Pacific to Europe helped absorb a near +90% surge in cross-border e-commerce volumes from China to Europe as per June data from China Customs. That reallocation has so far kept rates aloft. By contrast, Southeast Asia to Europe fared less well, with spot rates tumbling -22% year-on-year to $3.02 per kg.

The transatlantic market stands out as the only major corridor to post considerable rate increases in both directions. Spot prices rose to $1.91 per kg westbound and $1.15 per kg eastbound. A combination of frontloading activity and reduced bellyhold capacity from passenger flights nudged rates higher.

‘Piggybacking’ will stop – but when?

While this state of flux exists, air cargo gives shippers the opportunity to respond quicker and ‘that’s what they’re playing with,’ van de Wouw added. “My best assessment is that the confusion is encouraging more companies to use airfreight than would like to, but air cargo is proving its value once again.”

However, he says ‘the piggybacking will stop’ – adding that all the positivity created by double-digit air cargo growth in 2024 ‘now feels like a very long time ago’.

“There are still so many unanswered questions. How long will this uncertainty last? What will trade volumes look like in a few months’ time? What happens when U.S. consumers start to feel higher tariffs impacting the cost of goods?

“Economists agree this climate is not good for anyone and, sooner or later, something must give, and demand will fall. How long it will be before reality kicks in is hard to assess because this is one massive political dance. In the meantime, air cargo stands to benefit,” van de Wouw stated.

Global K9 extends WFS screening services

Air cargo detection company Global K9 is to provide canine teams, X-ray screening, and compliance officers at handler WFS locations in Dallas and Houston. GK9 will oversee all screening operations at both DFW and George Bush Intercontinental Airport (IAH), including the provision of certified canine handling teams, X-ray screening. Last year, WFS processed over 250,000 tonnes of cargo through its DFW facilities, and 115,000 tonnes through IAH.

GK9 has been working with WFS since 2021, and now delivers services across nine US cities, including Atlanta, Boston, Chicago, Los Angeles, Miami, Portland, and San Francisco, covering more than 25 of its facilities.

Latin America drives IAG growth

IAG Cargo increased revenues by 11.1% to €629 million (US$718m) in the first half of 2025 compared with the same period last year.

Latin America – Europe routes continue to be a key growth driver, with tonnage up 19.3% in the first half of 2025 compared to the same period last year. Shipments of its Critical product, for premium, time-sensitive goods, also increased by 30.5%,

Progress continues on the Global Cargo Joint Business with Qatar Airways Cargo and MASkargo, announced earlier this year and scheduled to formally launch in late 2025, subject to regulatory approvals. The combined networks will offer greater routing flexibility and expanded capacity across key trade lanes connecting Asia Pacific, the Middle East, Africa, Europe, the Indian Subcontinent, and the Americas.

The partners have also pledged a combined 1,000 tonnes of cargo capacity to support the UN World Food Programme’s humanitarian operations.

New finance chief for broker

Air Charter Service has appointed Kerry Holder as chief financial officer, taking over the position from Stewart Pitt who has held the role for 19 years and becomes a a non-executive director. She brings with her almost 30 years’ experience in finance, starting her career at KPMG in 1997 and as finance director at large companies.