Niall Prendiville has joined temperature-controlled shipping solutions provider CSafe as chief product officer. He brings engineering, automation, and supply chain operations expertise to the company and has led product development, engineering, and business transformations across high-tech industries, including warehouse automation, power systems, and aerospace. He will be based in Monroe, OH at CSafe’s corporate office.

Healthy people and healthy economies – industry partners to highlight vital role of airfreight

Pharma.Aero and TIACA (The International Air Cargo Association) have set up a Food and Farm for Health project to underscore the value and role of air cargo in healthcare access and economic development in low- and middle-income countries.

Developed in collaboration with the Cool Chain Association and the Humanitarian Logistics Association, it seeks to optimize air cargo’s potential to deliver life-saving medicines while simultaneously supporting local agricultural economies.

Leveraging the expertise of specialists in pharmaceutical logistics, humanitarian supply chains, and temperature-sensitive freight, the project will analyze global air cargo movements, assess their economic impact and evaluate their role in advancing the United Nations Sustainable Development Goals.

Secretary general of Pharma.Aero, Frank Van Gelder, said: “We recognized a critical gap and initiated this project to use air cargo as a dual-purpose tool: flying in life-saving pharmaceuticals and medical supplies while flying out perishable agricultural products – like fruits, vegetables, and flowers – from local farmers to Western markets.

“By utilizing available cargo space on return flights, we create a more cost-effective, efficient trade route. This approach not only ensures faster access to essential medicines and vaccines, but also opens new market opportunities for farmers, boosting local economies and providing better access to international markets.”

TIACA chair, Steven Polmans added: “Air cargo is more than a mode of transport – it’s a critical lifeline for economies and communities across the globe.

“From Kenya’s flower exports supporting millions of jobs to India’s seafood sector driving billions in trade, our work confirms that airfreight is a catalyst for opportunity, health, and resilience.

“As TIACA, we’re committed to building smarter, more equitable supply chains that serve both people and planet. This project is a key step in advancing that vision — and we thank all contributors for bringing their expertise and passion to this important work.”

Cool Chain Association board member, Ian Buck said: “Aligning healthcare providers in their mission to provide lifesaving treatments and preventative medicines to developing and emerging regions, and in turn giving those regions an economic reach for their home grown and produced perishable products is the balance we seek.

“Highlighting those connections and looking to forge partnerships and understanding with solid data at either end we hope will provide access and benefits for all.”

Humanitarian Logistics Association chief executive, George Fenton commented: “The aid sector recognises the need to change but is struggling to bring about transformation through evolution. There is a huge need to find innovative ways to strengthen local supply chain capability. The air cargo industry is vital to the fast delivery of humanitarian aid, yet the last mile is still the greatest challenge. The Food and Farm for Health project will provide valuable insights to support effective, sustainable, change through improved cross-sector coordination, collaboration and knowledge sharing.”

DHL buys second US e-commerce firm

DHL Supply Chain has acquired US-based e-commerce logistics provider IDS Fulfillment.

It adds over 1.3 million square feet of multi-customer warehouse and distribution space and includes facilities in Indianapolis, Salt Lake City, Atlanta, and Plainfield, Ind., where the company is headquartered.

In January, DHL acquired Inmar’s reverse logistics business, making it the largest returns processing provider in North America.

Chief executive of DHL Supply Chain North America, Patrick Kelleher, said: “The acquisition of IDS Fulfillment not only expands our operational footprint but also ensures small and midsized companies have access to our state-of-the-art logistics solutions designed for their specific requirements.”

Global chief executive of DHL Supply Chain, Oscar de Bok, added: “With global e-commerce set to grow at a CAGR of 8% per annum by 2029, DHL is targeting investments that further expand our capabilities to meet the needs of this growing segment and make our network and solutions easily accessible to businesses of all sizes. IDS Fulfillment complements our existing DHL Fulfillment Network, enhancing our ability to offer seamless global eCommerce solutions with local expertise and reach. Especially timely as more multi-national organizations are looking to establish fulfilment capabilities in North America.”

Challenge opens up in Bangalore

Challenge Group has launched a freighter service to Bangalore, India, just one year after launching services to Mumbai. The Bangalore service is operated with a Boeing 767-300BDSF freighter, offering a 50-ton capacity.

The Belgian-based freighter operator also maintains daily connections between Tel Aviv and Liège. From Tel Aviv, cargo also moves twice a week directly to New York while Liège is also connected to New York with five weekly flights,. It also operates weekly freighter services from Liège to Houston, along with twice-weekly flights to Atlanta.

Emirates to link Hangzhou with Latin America

Emirates will launch daily services between Dubai and Hangzhou from 30 July, its fifth gateway on the Chinese mainland after Beijing, Guangzhou, Shanghai, and Shenzhen. It will operate with a Boeing 777-300ER, offering connections to and from in Europe, Africa, the Middle, Brazil and Argentina. Expected traffic will include electronics, e-commerce, pharmaceuticals, and perishables.

New chief exec for Global GSA Group

Global GSA Group has appointed Aytekin Saray as its new chief executive Officer. He started his airfreight career at Panalpina in 1996 and joined Global Airline Services (now part of Global GSA Group) in 2000, playing a key role in its success as chief commercial officer and managing director for Central Europe.

How bad can it get? Air cargo market awaits impact of tariffs and de minimis changes

Global air cargo volumes grew +4% year-on-year in April but with the removal of the de minimis threshold for shipments from China into the US on 2 May is expected to dramatically disrupt e-commerce volumes in the coming weeks.

And, with massive uncertainty hanging over the macroeconomic outlook, the question for the air cargo market in 2025 has become ‘how bad will it be?’ says industry analyst Xeneta.

Over the past ten years, US consumers have paid no duty on shipments valued at $800 or less, leading to soaring volumes of cross-border packages into the US of some 1.35bn annually. Similar (but lower) exemptions exist in other countries.

But from 2 May, low-value products sourced from China and Hong Kong into the US will now be subject to new 145% tariffs, or 120% for products sourced from postal services – or a $100 flat fee, rising to $200 on June 1.

Around half of air cargo shipments on the China–US route are e-commerce, accounting for around 6% of global volumes. A sharp drop in demand is likely to challenge carriers’ capacity planning, with early signs already pointing to freighter flight cancellations and potential redeployments to other trade lanes.

One of China’s e-commerce behemoths, Temu, has already responded by dramatically reducing its advertising spend in the US, but the outlook for global air cargo – so dependent on e-commerce income for the last 2-3 years since Covid – extends far beyond the US border, says Niall van de Wouw, Xeneta’s chief airfreight officer.

“This is a double-edged sword. A decrease in demand on one of the key airfreight lanes between Asia Pacific and North America will have a big impact, but so too will the redeployment of capacity on a global level,” he said. “This may be a year when we grow weary of seeing the word ‘unprecedented’ in market performance statements. The macroeconomic picture will depend on how long the uncertainty lasts and what will be at the end of it, but the outlook currently looks quite daunting.

“This is not about one industry being affected. This is about major trade lanes being affected, and we haven’t seen anything on this scale before.”

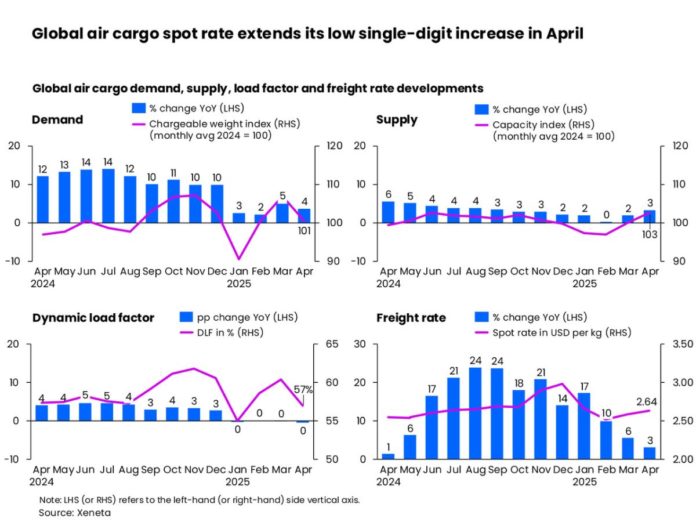

Weaker market demand in April and downward pressure on rates

In April, global air cargo spot rates rose just +3% year-on-year, a second consecutive month of only single-digit increases. This slowdown aligns with weaker demand trends. Adding to the downward pressure on rates, jet fuel prices fell -24% year-on-year in the first three weeks of April. This drop, driven by ongoing economic and geopolitical uncertainties, likely played a role in tempering overall spot rate growth.

Meanwhile, available capacity increased modestly, up +3% compared to April 2024, and the dynamic load factor declined three percentage points month-on-month to 57%.

Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

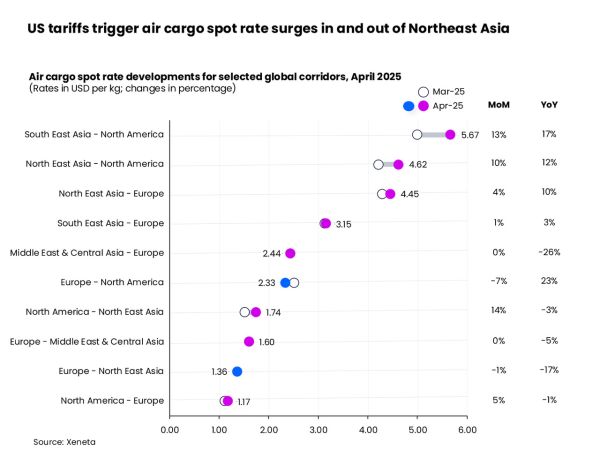

US tariff measures implemented on the country’s so-called Liberation Day on April 2 prompted a rush of air shipments from several Asian countries to North America. This led to double-digit increases in both volume and spot rates. Notably, spot rates from Southeast Asia to North America jumped +13% month-on-month, while those from Northeast Asia rose +10%.

However, these gains began reversing in the second half of April following the announcement of a 90-day tariff pause and +145% retaliatory tariffs on China.

The largest monthly rate surge was observed on the North America–Northeast Asia corridor, rising +14%. This was largely driven by shippers rushing exports to China and Hong Kong amid fears of reciprocal tariffs.

Elsewhere, spot rates between the Middle East, Central Asia and Europe remained flat month-on-month but were down year-on-year, especially into Europe (-26%) , reflecting easing supply pressures from earlier Red Sea disruptions.

Transatlantic westbound rates, meanwhile, declined -7% from March, impacted by increased bellyhold capacity from summer flight schedules, as well as seasonal slowdowns during the Easter holidays and potential US tariff actions.

On the Northeast Asia–Europe corridor, fronthaul rates into Europe saw a slight month-on-month increase and were up +10% year-on-year. However, backhaul rates into Northeast Asia fell sharply, down -17% compared to April 2024, as trade imbalances persisted.

Wait and see

April’s market data failed to provide many indicators for the year because the uncertainly since the start of the month was just ‘pushed back,” van de Wouw said.

“Nothing has really changed in the past month. The global air cargo market is in an intermediate state. It’s very difficult for companies to relocate their sourcing to avoid tariffs, but they are looking at ways to reduce the impact, still not knowing what the final impact might be. The big question for everyone is what will this year do?

“The de minimis change in the US is going to disrupt the market and we’ll see its impact in the May numbers. I would say be prepared for a logistical mess.

“I wonder how many US consumers are aware there was a de minimis rule and that it has now been revoked. But that’s about to change. One industry colleague from Cirrus Global Advisors in the US posted earlier this week that the ‘best-selling’ item from China, a $19.49 power surge protector, was $48.38 in his Temu shopping basket by the time shipping and import taxes had been added. His message, quite correctly, is that the days of free shipping from China are over,” van de Wouw continued.

After double-digit air cargo market demand growth in 2024, forecasts going into 2025 predicted another 4-6% growth year-on-year. Any attempts to reassess the outlook in the current market conditions would be “meaningless,” he said.

“The likelihood of lower airfreight rates are better news for shippers and forwarders but if shippers can’t sell their goods because of tariffs, that’s bad news for the macroeconomic picture and the need for airfreight. For most airfreight shipments, lower rates will not compensate for the tariffs that will have to be paid.

“Therefore, it’s still a waiting game to see how long this process takes and the order of magnitude of which the tariffs will stick,” van de Wouw stated.

Right now, he added, all eyes are on e-commerce.

“This is quite likely the calm before the storm. If the new de minimis set-up remains – and why would they change it after the investment the authorities have reportedly made – then this will undoubtedly negatively impact airfreight volumes from China to the US. The traditional airfreight market will not be able to compensate for the decline in e-commerce volumes.

“Airlines will adjust their networks to this new reality and this, in turn, will have a beneficial impact for shippers around the world as they will see more capacity coming (back) to their market – but they still need viable trading conditions to enjoy the benefit of this opportunity.”

Seafrigo sees Chile opportunities

Food logistics specialist Seafrigo has opened two new offices in Chile – an operational hub at Santiago Airport and a commercial office in Las Condes, northeast of the city. The company currently handles a diverse range of Chilean exports by air, including cherries to Asia, custard apples and salmon to the US, swordfish and flowers to Europe, and seeds to Australia.

Seafrigo is also seeing a steady rise in imports into Chile, including cheese, wine, and chocolate from France and the US.

Leading the new Chilean operations is Denis Hidalgo, an industry veteran with 22 years of experience in air and ocean logistics.

Seafrigo is also exploring opportunities in Peru, another country with significant year-round perishables exports.

Access all airlines with Cargo.one

Freight forwarder Kuehne+Nagel has signed a partnership with the Cargo.one platform to connect to dozens more airlines and general sales agents across the globe.

Cargo.one’s API Suite will enhance the forwarder’s proprietary air freight booking platform, CB Air, leveraging Cargo.one’s airline network and real-time connectivity. This partnership complements Kuehne+Nagel’s direct airline integrations, strengthening its digital procurement and booking capabilities.

Kuehne+Nagel will benefit from cargo.one’s continuous data quality assurance, expanding airline partnerships, and expert support. It aims to deliver faster, more accurate quotes and a frictionless booking experience.

Lufthansa flies first A380 to Mile-High City

Lufthansa is operating an Airbus A380 to Denver for the first time, from its Munich hub. It is also a premiere for Denver, the third largest airport in the US, as it is the first time it has received an aircraft of this size. Denver is Munich Airport’s sister airport, a decades-long partnership based on the close economic and cultural ties between Bavaria and Colorado. Lufthansa has eight Airbus A380s based at its Munich hub.