Analyst Clive Data Services said that air cargo demand growth may be a few quarters away as August spot rates hit their lowest level in over three years.

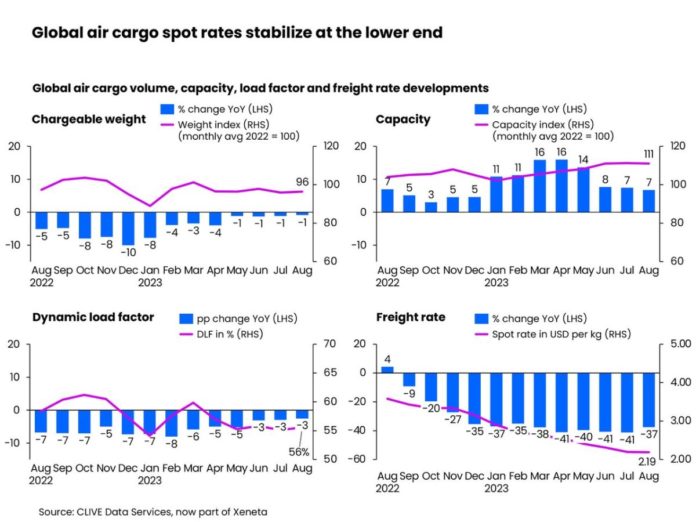

The global air rate flattened to US$2.19 per kg in August, its lowest since the pandemic as another weak summer month saw chargeable weight edge -1% lower for a fourth consecutive month, according to the latest weekly market analysis from the airfreight arm of Xeneta.

While shippers and forwarders continue to benefit from the overall decline of general air freight rates, rising jet fuel prices should concern an already contracted market, with the US gulf coast jet fuel spot price jumping 21% month-over-month.

August saw global air cargo capacity rise 7% year-on-year, while Clive’s global dynamic load factor, which measures cargo load factor based on both volume and weight perspectives of cargo flown and capacity available, climbed one percentage point about the previous month to 56%. But the August global load factor continued to fall year-on-year, down 3% from last year’s level. Softened global demand and the capacity surge were the main reasons behind this.

Clive says that the data dampens some industry reports of a slight spike in demand in August, leading to hopes of a rise in volumes going into the final four months of the year.

“We are picking up signals that it could take another few quarters before we see more demand on a global level,” said Xeneta chief airfreight officer, Niall van de Wouw.

“August was very quiet, like July, and we see no meaningful signals from a qualitative or quantitative point of view of any kind of peak arising this year. There might be some early peak season charter requests floating around but they are backed up by very little demand. The (low) rates and the limited timeframe that the requestors are looking for signal that they are not too concerned at the moment about getting the required capacity when they actually need it.

“The market seems to have levelled out, but still holds a lot of uncertainty, and not just for airfreight. There was also no peak for the ocean market, which typically precedes the airfreight market by a couple of months. There are even blank sailings scheduled ahead of the Golden Week period.

“There is likely to be upward pressure on airfreight rates in the second half of October as capacity is taken out of the market, but it’s getting late in the game to positively impact the industry’s 2023 performance, and the signals for the rest of the year are not good given the macroeconomic outlook hasn’t improved.”

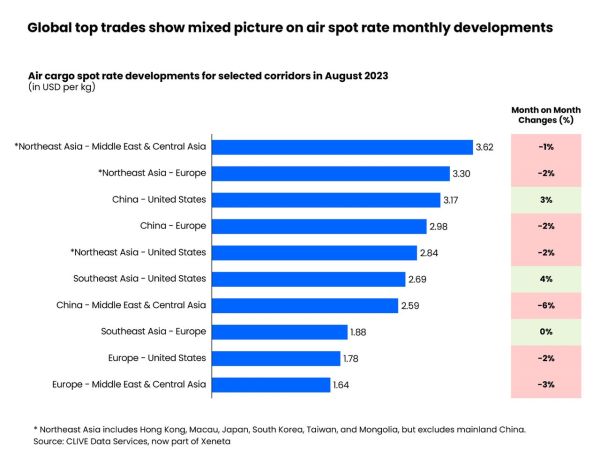

Average general airfreight rates in August dipped as low as $2.13 per kg in the first two weeks of the month. Of the major trade lanes, only China-US and Southeast Asia-US recorded growth, with spot rates up 3% and 4% respectively. This is attributed to a more resilient US economy with strong retail sales and, to some extent, also delayed recovery of US-China passenger bellyhold capacity, which is growing at a much slower pace than Europe-China.

Even so, due to capacity shortage triggered by various geopolitical issues, airfreight spot rates ex Northeast Asia to Middle East & Central Asia, Northeast Asia to Europe, China to the US and China to Europe remained highly elevated, still up by around 55% from their pre-pandemic levels.

Looking forward, the oceanfreight container market might shed some light on where the air cargo market is heading, as it tends to begin its yearly peak season a few months ahead of the airfreight cycle. So far, the global ocean container market has not shown any meaningful peak season trends.

“The air cargo industry is coming to terms with the market conditions and not even the current and planned restrictions we see on container ships moving through the Panama Canal are likely to provide a noticeable uptick to airfreight volumes. Whichever way you choose to look at it, demand growth simply does not exist in this current moment or for the foreseeable future.

“Shippers will no doubt be tempted to fix more longer-term deals because the levelling of volumes and the imminent drop-off of some capacity means the market may not get any better than it is right now for capacity buyers,” Niall van de Wouw said.