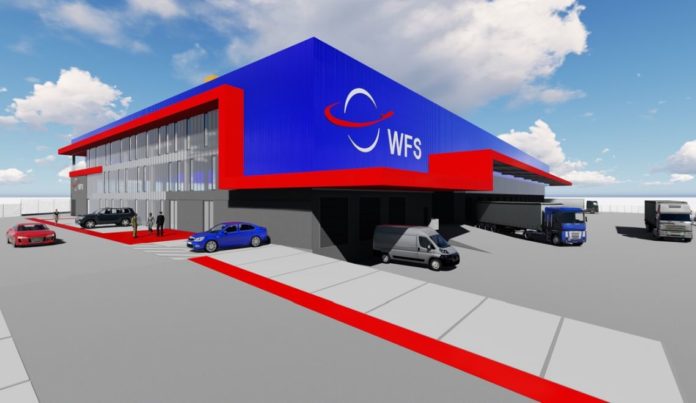

Worldwide Flight Services (WFS), a member of The SATS Group, is to open a fifth cargo handling terminal at Adolfo Suárez Madrid-Barajas Airport.

WFS aims to begin operations from the6,500sq m (69,965sq ft) facility by the end of the first quarter of 2024, increasing its total cargo facility footprint in Madrid to 17,000sq m (183,000sq ft).

WFS has been present in the Madrid cargo and ground handling market since 1998 and serves 39 airline customers, as well as providing trucking services connecting other key airports in Spain and across the EU.

The new building will offer 17 landside truck and van docks, two build-up-pallet lanes and docks, four airside truck and dolly docks with tilting and 20-foot ULD handling capabilities, a secured refrigerated cargo acceptance area, 2-8°C and 15-25°C loose and mechanised temperature-controlled cool rooms and a mechanised handling system connecting the landside and airside docks.

Like WFS’ other cargo terminals in Madrid, it will be powered by 100% renewable energy, including solar panels located on the roof. Indoor AGV (Automated Guided Vehicles) will also be introduced into the facility in the second half of 2024.

Digitisation initiatives will include the launch of Cargospot mobile warehouse technology, the CargoKiosk system to automate and expedite truck processing times, and a Warehouse Workflow Monitoring System.

Managing director of WFS in Spain, Humberto Castro, said: “Madrid is such a strategically important cargo market as a hub for Central and South America to and from the EU and connecting the Middle and Far East markets. This new cargo terminal will help to future-proof WFS’ service offering by increasing our handling capacity by 60% for our current and future airline customers.

“This will enable us to accommodate strong organic growth and support the significant increase of inbound e-commerce traffic from China.”