Abu Dhabi Airports has joined the Pharma.Aero global network for life science and medtech manufacturers, as a strategic member representing the Middle East.

It said the collaboration would build on Abu Dhabi’s growth as a global healthcare and life sciences hub, and the success of the HOPE Consortium, an Abu Dhabi-led public private partnership that is committed to working together to overcome the challenges of vaccine distribution and logistics.

Abu Dhabi Airports is set to pursue major air cargo infrastructure expansion projects with a strong focus on products capable of efficiently handling time and temperature-sensitive cargo, including those from within pharmaceuticals and life science.

Pharma.Aero chairman Trevor Caswell, said: “We are thrilled to have Abu Dhabi Airports join Pharma.Aero as a strategic member for the Middle East region. We look forward to a strong, active and collaborative partnership with them as we welcome them on board.”

Frank Van Gelder, secretary general of Pharma.Aero, added: “Developing active and far-reaching airport pharma communities is essential to the core strategy of Pharma.Aero – therefore, it is with great pleasure to welcome Abu Dhabi Airports as the new strategic partner for the Middle East. We are confident that their participation, along with Etihad Cargo, will pave the way for the future of our association in the region.”

Abu Dhabi Airports joins pharma group

Finnair FIRST offers capacity guarantee

Finnair Cargo’s FIRST premium service now includes a capacity guarantee. This means that even on a fully booked flight there is the option to choose a FIRST booking within that capacity guarantee.

The service is for situations where a customer urgently and regardless of cost wants to make a booking for a specific flight.

There is also a money back guarantee which pays the customer 50% of the booking price refunded if it cannot be executed as promised, subject to conditions available on the FIRST website.

First cargo customers are also being offered round the clock customer service and support. Local offices will continue service as before during local office hours, but in addition, a chat service is available at Finnair Cargo’s hub at Helsinki Airport 24 hours a day.

Envirotainer gears up to move a billion doses a year

Active airfreight container firm Envirotainer has expanded its production site in Rosersberg, just north of Stockholm in response to high demand for temperature-controlled units to transport medicines. This year alone, the business will add annual shipping capacity for around 200 million more doses and by the end of 2022 will be capable of shipping over one billion vials per year.

The company says that the site is the largest in the world, able to build more units each year than any other and has been designed for further expansion. The Envirotainer fleet covers more than 2,000 pharmaceutical trade lanes in over 100 countries and 300 airports.

Envirotainer describes its new Releye RAP and RLP models as the largest and most advanced of their type on the market and help companies meet the strictest requirements for pharma air freight

Head of quality control and production manager, Sofie Nordhamren, said: “The demand for our services has been sky-high since the start of the pandemic. The need to safely transport pharmaceuticals while minimising wasted space in precious air cargo has increased dramatically.

“The added capacity will help our customers be more efficient, sustainable, and reduce the likelihood of a temperature deviation to virtually zero. This nearly eliminates the likelihood of valuable product loss.”

Freighters to take lion’s share of global air cargo growth, says Boeing

Plane maker Boeing is forecasting strong demand for air cargo services over the next two decades in its 2022 World Air Cargo Forecast (WACF), published on 9 November.

It expects traffic to double, while the world freighter fleet will expand by more than 60%.

The latest WACF projects that the world’s cargo fleet will require nearly 2,800 production and converted freighters for growth and replacement up to 2041. This will be made up of about 940 new freighters and about 1,855 conversions of passenger aircraft.

With cargo traffic doubling over the forecast period, operators will need to switch to more capable and fuel-efficient jets like the 777-8 freighter to meet demand.

Overall, the global freighter fleet will grow by more than 1,300 airplanes to more than 3,600 jets over the next two decades.

Currently, there are about 300 more freighters than existed in 2019, an increase of well over 15%, said Boeing. Utilization of the fleet also rose, and the current average number of flight hours for aircraft is still about 25 to 30% above pre-pandemic levels.

About 1,400 cargo aircraft will need to be replaced in the coming decades including many were used over the course of the pandemic that were probably past normal retirement age, including some that came out of the desert to serve as “emergency” freighters.

Over half the global freighter fleet is at least 20 years old with over 350 aircraft needing replacement, says Boeing.

At a press conference to launch the latest WACF, Boeing vice president of commercial marketing, Darren Hulst, said: “While the air cargo market is returning to a more normal pace after historic demand in the last two years, structural factors including express network growth, evolving supply chainstrategies and new cargo-market entrants are driving sustained freighter demand.

“In the global transportation network, air freighters will continue to be a critical enabler to move high-value goods, in increased volume across expanding markets.”

The 2022 WACF also predicts that the Asia-Pacific region will take delivery of nearly 40% of all freighters, both new and converted.

It added that while dedicated freighters make up just 8% of the total commercial aircraft fleet worldwide, they continue to carry more than half of all air cargo, with passenger airplanes carrying the remainder as belly cargo.

Hulst said that at one point over 70% and maybe closer to 80% of air cargo capacity was provided by dedicated freighters around the world, much higher than the long term average of around 50-60%.

Hulst described cargo as “relatively the bright spot in commercial aviation since the beginning of the pandemic.” Revenues were 70% higher on air cargo in 2021 than they were in 2019 and should roughly maintain those levels in 2022. It was, he said “a testament to the reliability and speed of air cargo as a function of trade, of moving goods and keeping supply chains moving.”

In recent months, there had been some changes to the dynamics of the marketplace, he continued. Some of the pandemic strains are easing in air cargo, partially due to economic effects and also because belly capacity is returning. However: “As schedules move closer and closer to pre pandemic levels remarkably, the revenues, the yields continue to stay very elevated, demonstrating again the value of cargo. But some of those pandemic effects are easing off from unprecedented highs. Economic uncertainty around the world continues to be a focus and that will probably have some effect in the near term on air cargo, on trade, especially as the key driver for air cargo.”

He added: “We continue to see the strength of e commerce networks developing around the world, especially in emerging markets…And it requires kind of a basic level of aircraft to support those e-commerce frameworks, those air networks to support the demand that continues to grow especially in emerging markets.”

Big e commerce names are joining with airlines or creating airlines to create their own networks to satisfy tremendous demand, Hulst predicted.

New operators are entering the cargo space, including those that haven’t operated freighters in the past or who want to grow their freighter networks or want to diversify into carrying freight in addition to passengers. Hulst estimated that there are now around 40 new cargo operators.

Boeing believes that air cargo traffic will grow about 4% per year for the next 20 years, slightly higher than passenger traffic. Growth in the number of freighter aircraft will be about the same, at about 2.5 to 3%.

While flows such as Asia to North America or Asia to Europe remain important, the highest market growth rate will be within East Asia, Hulst forecast. This market would, become the third largest flow by 2041, he predicted.

Also, over the last three years domestic air tonnage in the US market has grown by almost a quarter, relative to only about 1% growth in trucking.

Meanwhile, inter-European express shipments have almost tripled since the beginning of the century.

The complete 2022 World Air Cargo Forecast can be found at: www.boeing.com/wacf.

((Pic – Boeing 777F))

New AN225 ‘being built in secret location’

Work to build a new version of the Antonov AN-225 Mrija – the sole operational example of which was destroyed by Russian forces after they invaded Antonov Airlines’ Hostomel base early in the Ukraine war – has already started at a secret location, according to press reports.

In an interview with the German Bild magazine, Antonov general director Eugene Gavrylov said that the new AN-225 has already been 30% reconstructed. “Work on the machine is going on in a secret location. The never completed second AN-225 will be supplemented with parts of the bombed machine and new parts,” he added.

An airframe for a second AN225 exists, the aircraft never having been completed as it was deemed that single example would satisfy global demand

According to the report, rebuilding the AN225 could cost €500m, rather less than the initial €3bn estimate, which was based on a complete new-build. Some parts from the destroyed aircraft in Hostomel could also be recycled, Gavrylov added.

While Antonov Airlines cannot give an exact completion date for the new Mrija, Gavrylov is quoted as saying: “But the sooner the war is over, the sooner we can say that.”

Antonov Airlines meanwhile continues to operate is fleet of AN124 aircraft from a temporary base at Leipzig/Halle Airport.

Emirates orders five more freighters

Emirates has made a firm order for five new Boeing 777-200LR freighter aircraft, two of which will be delivered in 2024 and three in 2025. The agreement, worth over US$ 1.7 billion at list prices, takes the airline’s total order book to 200 wide-body aircraft.

Chairman and chief executive of Emirates Airline and Group, Sheikh Ahmed bin Saeed Al Maktoum, said: “This order reflects Emirates’ confidence in airfreight demand and overall aviation sector growth. It lays the ground for our continued growth, which is driven by the reach of our diverse global network, the advanced handling infrastructure at our Dubai hub, and the tailored transport solutions that Emirates has developed to serve our varied customers’ needs.”

At last November’s Dubai Airshow, Emirates announced a US$ 1 billion investment to expand its air cargo capacity, including two new 777Fs which have already joined the fleet in 2022 and plans to convert ten Boeing 777-300ERs into freighters, scheduled to begin in 2023.

It currently operates a fleet of 11 Boeing 777 freighters, in addition to bellyhold cargo capacity.

We can hold your horses, says Air Canada

Air Canada Cargo has launched a horse transport service using its new Boeing 767-300 freighter aircrafts. It will use specially-designed stalls provided by Unilode, with up to three animals per unit and attendants will be accommodated on the same flight in upper deck seating. They will be able to check on the animals in-flight, ensuring they have water and are well cared throughout their journey.

The carrier will offer the service in North America, Europe and Latin America via its Toronto hub. Facilities in Toronto include comfort stop barn to hold horses in comfort at any point during their journey.

Earlier this year, Air Canada become the first airline to be re-certified by IATA for the safe transport of live animals.

Air Canada Cargo managing director, commercial, Matthieu Casey, said: “This new highly specialized service is another sign of our continued investment in our facilities and international network to better serve our customers. Air Canada Cargo takes great pride in the safe and humane transport of animals, and our new equine product we offer to our customers, from the facilities and stalls that provide the highest standard of safety and care for these magnificent animals to our ability to accommodate attendants onboard is state of the art from end to end.”

IAG restarts Madrid-Latam flights

IAG Cargo has revived services from Madrid Barajas Airport to Caracas (Venezuela) and Rio de Janeiro (Brazil). They will operate three times a week using the bellyhold of an Iberia A350 aircraft and an A330-200 to Rio de Janeiro.

Iberia recently says it has now re-established its entire network of flights and destinations in Latin America.

IAG Cargo transports large volumes of perishables out of Central and South America to European markets.

No Christmas turkey yet for cargo airlines as demand refuses to fly

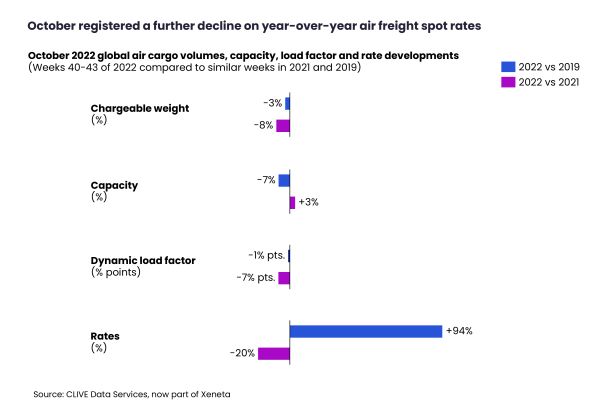

There’s no sign of an early Christmas for air cargo carriers says Xeneta-owned analyst CLIVE as volume carried declined -8% year-over-year in October – the eighth consecutive monthly fall – and there are no current signals to indicate an upturn in 2023.

The drop in demand, measured in chargeable weight, was also -3% below the pre-pandemic level in 2019.

Compared to last year’s levels, global air cargo capacity continued to recover in October but at a slower pace and remained -7% below the pre-Covid 2019 level. This contributed to a more subdued ‘dynamic loadfactor,’ CLIVE’s measurement of airline performance based on both the volume and weight perspectives of cargo flown and available capacity.

As falling demand meets rising capacity, load factors have been declining over the past 18 months. In October, the 61% dynamic loadfactor was -7% pts and -1% pts in comparison to 2021 and 2019 respectively.

October saw a second consecutive month of lower global airfreight spot rates below last year’s level.

Xeneta chief airfreight officer, Niall van de Wouw, commented: “We are six weeks away from Christmas and there is no indication there will be a peak. Demand worsened in October over the -5% reduction we reported in September, but this is not likely to surprise the market given the global economic outlook, although it’s clear that rates remain at a higher level than some observers would have expected in the current conditions.”

But he added: “Airfreight is certainly not currently suffering the decline of ocean, where Xeneta has recorded rate drops of 60%-70% in the last nine months. Ocean freight is responding to the market conditions much faster than air is and normalising quickly from a rates point of view.”

The outlook for air cargo remains uncertain, says Niall van de Wouw. “We don’t see a pressure on capacity, and we don’t see an increase in rates.

Looking ahead, he expects more challenges over the next 12 months: “I see very few signals that would support an increase in general airfreight in 2023 – be that because people have higher personal bills or because people are spending more on services relatively to goods.

“It is also fair to assume that even if consumers in Europe and North America were to buy exactly the same amount of goods in 2023 as in 2022, which is unlikely, then a higher portion of the transportation in support of that, whether it’s the finished products or the hard materials to make those products, is likely to move by ocean as a response of the higher reliability returning on the sea.”

Airfreight received a boost in the last two years because of the “incredible mess” in ocean freight, but shippers are now likely to feel more comfortable moving back to ocean from a reliability point of view. With all these factors combined, I don’t see where a lot of general freight growth demand drivers will come from.

“On the supply side, the opposite is true. People are becoming more comfortable about flying again and routes are opening up, leading to a rise in belly capacity, and the freighters being ordered and cargo conversions will also be coming to the market.

“The only development I can see that would slow down the decline in rates is supply on the ground. If airlines and cargo handling companies continue to struggle to hire people and remain short-staffed, then the bottlenecks will create an upward pressure on rates because it will be difficult to get your goods through the value chain.”

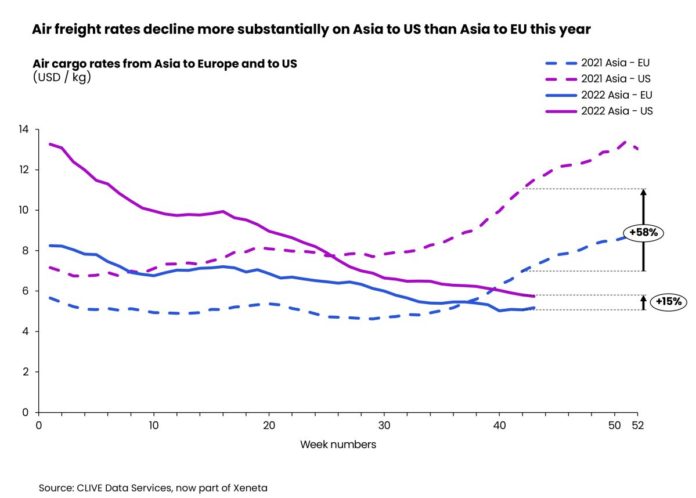

Airfreight rates on top volume corridors from Asia to Europe and Asia to the US continued to fall in October, while general rates fell more substantially on inbound US corridor routes than inbound Europe. This is attributed to added costs for EU routes, due to the closure of Russian airspace and lower spending by US consumers.

Europe to US airfreight spot rates stood at USD 3.11 per kg in October, down 27% from the 2021 level, while Asia to Europe spot rates fell USD 5.09 per kg, down 25% year-over-year. Asia to US registered the sharpest decline among the three top volume corridors, with the average spot rate down 45% from October last year to USD 5.87 per kg.

In comparison, the Latin America to US corridor showed more resilience to market headwinds, although its airfreight spot rate slid 11% to USD 1.38 per kg in October.

Shippers, however, may not be seeing long-term gains from falling airfreight rates right away, Niall van de Wouw says: “There is a lot of uncertainty, so this is not a period where shippers will get an ‘attractive’ deal for the next year or two years, they will get lower rates for the next one to two quarters, but who knows what will happen beyond that.”

Is this airfreight’s greenest truck yet?

Air France KLM Martinair Cargo (AFKLMP Cargo) and Jan de Rijk Logistics have joined forces to operate a Long Heavy Vehicle (LHV) which, moreover, will run on Hydrotreated Vegetable Oil) (HVO).

LHVs with a maximum gross weight of up to 60 tonnes and up to 25.25 metres long are allowed by a number of European countries under controlled conditions. AFKLMP Cargo says its LHV can carry six unit load devices (ULDs) compared with only four for a standard truck, substantially reducing CO₂ emissions.

The new LHV will be used exclusively between Amsterdam Airport Schiphol and Frankfurt am Main, two major AFKLMP Cargo hubs.

HVO fuel, also known as “blue diesel” can reduce CO₂ emissions by as much as 89% and, say the partners, is the first of its kind.

AFKLMP Cargo and Jan de Rijk will continue their research including development of electric trucks and the use of hydrogen as a sustainable fuel.